“Without revolutionary theory there can be no revolutionary movement.”

At the end of the 20th century humanity was given the most powerful tool that the world has ever seen: the internet. In less than 20 years, the internet has evolved from being a slow, complex, obscure piece of technology to connecting billions of people today with just the flick of a button. Despite the fact that we can use the internet to communicate more efficiently, and exchange information with magnitudes more efficiency then just a few decades ago; we still find the shadow of fascism grow larger with each passing day…

Control of our respective economic, political, and social systems have been overtaken by corrupt capitalist and their political stooges, and now they seek to take over the internet itself. It does not matter if you are German, Korean, Argentinian, or American–all of our systems have been corrupted in the same way, with the same methodology, by the same class of people. Corruption reigns supreme, while the basic needs of society as a whole are ignored. Self-determined humans everywhere have been hamstrung by economic corruption, government impotence, and social cowardice to ensure that the wealthy will always win.

This is THE defining feature of ALL so-called democracies around the world. Unless we choose to fight this corruption directly and to strike at the single root which unites them; we will continue to suffer under their exploitation. The single feature which unites them is fiat money; and that is the very structure–the very object–which we seek to destroy. Through the promotion, advocacy, and use of digital currencies we can destroy the contemporary financial system, which is controlled by the 0.1% at the expense of the whole of society.

Politics and Economics are Inseparable

We must understand that there is absolutely no division between economics and politics. It is by the very make up of our political and monetary system that all economic conditions are determined. It is only when we fully recognize that political power is only economy power that we will be able to create the revolutionary struggle against all state monetary systems and their kleptocratic allies.

We must understand that there is absolutely no division between economics and politics. It is by the very make up of our political and monetary system that all economic conditions are determined. It is only when we fully recognize that political power is only economy power that we will be able to create the revolutionary struggle against all state monetary systems and their kleptocratic allies.

Never has there been a greater need for true radicalism to emerge to challenge the fascism hidden in the folds of all governments. We must radically divide ourselves from every other supposed ‘political’ group in order to make our struggle clear. Each and every sort of progressive movement throughout the world today finds itself under the constant glare of the fascist machine to ensure it remains complacent and broken. Threatened to be violently crushed back down each time we rises up; the people callow under the glare of the machine like cattle calmed by the hushes of butchers. For the first time in history, there is a real possibility for true international proletarianism, if we choose it.

We can use the internet to as our revolutionary vehicle to organize ourselves, and digital currencies as our method to create economic independence. All that is left is to create the organizational structure that will create a new future, in solidarity will all oppressed people everywhere.

As this new form of power grows to show what it is capable of, a new power structure will form–a polis within the internet itself, which will become the citizenship of the future.

From this base of power we can start to organize against all states, and the corporate machines that control them. As our membership grows, so will our political practice, and our political consciousness. This is how we build a new future outside and beyond the horrors that currently haunt the future which we are marching into.

Beyond The Spectacle

Despite the incredible power of the internet, today we stand stunned and seduced before it; subject to it, rather than subjugating it. We are hypnotized by the taste of the social architecture; the dazzle of infinite distraction. We succumb to the inertia of the impossibility of our task; feeling no more than a hollow glimmer that a different world is possible. Today even the most ‘radical’ solutions are little more than an impotent sigh; a sign of caring imbued with defeat from the start. Not an action of true struggle, but the compromises of slaves who know freedom can never be a reality.

Despite the incredible power of the internet, today we stand stunned and seduced before it; subject to it, rather than subjugating it. We are hypnotized by the taste of the social architecture; the dazzle of infinite distraction. We succumb to the inertia of the impossibility of our task; feeling no more than a hollow glimmer that a different world is possible. Today even the most ‘radical’ solutions are little more than an impotent sigh; a sign of caring imbued with defeat from the start. Not an action of true struggle, but the compromises of slaves who know freedom can never be a reality.

The Left, crushed and broken for decades, has become little more then a false idol to placate the the liberal masses. To offer some illusion of progressiveness is the sole duty of liberalism, while allowing for nothing to change. Even socialist today are little more then apologist for the capitalist system, only wishing for a more ruthless exertion of state control upon capital.

If want to create a new way forward, the only way is to break the bonds of the old system itself: Money.

By break the antiquated money system of old, while cultivation any new one they do not control; we can change everything.

The New Way Forward

Every party today wishes, beg, and cowtows for The Machine of State-Capitalism to change its horrific ways.

Where is the party to which would stand and fight against this Machine? Where is the party that would crush it where it stands and to uncompromisingly disassemble each and every last cog of the machine to make way for a better tomorrow? Where is this party that proclaims to be a true representative of the people? This party is nowhere to be found, which is why we must lead to a new way of life that is beyond parties and politics.

It is this false hope that a ‘party’ can steer the state and use that power for good which is the greatest enemy of our cause. To believe in the legitimacy of a corrupt electoral system only empowers the corrupt, and legitimizes their evils. To truly create change we must go beyond the false political consciousness we have been given, and construct a radical new one.

No Gods of Government, No Masters of Money.

We radically divide ourselves from the liberals, socialist, communist, and libertarians who refuse to work towards a better tomorrow without the state, and against the capitalist machine. They beg and plead to reform this horrible system, and would rather tolerate a corrupt, inept government; then acknowledge the puppet democracy for the false idol it is. It is only when we realize reform is impossible, that we will be free to achieve inevitable:

Revolution!

To Create a Revolutionary Future

We must create our own organization that stands against the evil anachronistic ways of the past, while radically embracing the liberative power that digital technology harnesses. We must make a global technology union for all people that will stand, serve, and protect the rights of each individual against the interlopings of all thieves; be it in the form of banks, the state, or violence itself. This is what will become the citizenship of the new society that is forming in the shell of the old.

Everything we need to change money–which changes everything–is in our hands. The only thing left to do is to build, collaborate, and create the future we must have.

“For the anarchist, freedom is not an abstract philosophical concept, but the vital concrete possibility of every human being to bring to full development all of their powers, capacities and talents with which nature has endowed them, and turn them to social account.” ― Rudolf Rocker

Buried deep in the annals of history we find the powerful revolutionary praxis of syndicalism. Originally a radical movement for trade unions; syndicalism pulled its principles from “

Buried deep in the annals of history we find the powerful revolutionary praxis of syndicalism. Originally a radical movement for trade unions; syndicalism pulled its principles from “ The profound power of Syndicalism arises out of the nihilistic tradition of taking the mantel of God for oneself. Those that are of the Syndicalist’s teachings seek spiritual meaning, and a bond with one’s own God for which they fight: themselves and their communities.

The profound power of Syndicalism arises out of the nihilistic tradition of taking the mantel of God for oneself. Those that are of the Syndicalist’s teachings seek spiritual meaning, and a bond with one’s own God for which they fight: themselves and their communities. The power message of syndicalist can and is easily be vulgarized to serve national socialist, and their racist, authoritarian, ignorant perspectives. Fascism is the greatest form of government for the weakest and most sniveling cowards of democracy. This is what happened in Italy in 1924, Germany in 1932, and Spain in 1936 where the fascist seized power because of the cowardice of pathetic democratic governments that could not stand against them.

The power message of syndicalist can and is easily be vulgarized to serve national socialist, and their racist, authoritarian, ignorant perspectives. Fascism is the greatest form of government for the weakest and most sniveling cowards of democracy. This is what happened in Italy in 1924, Germany in 1932, and Spain in 1936 where the fascist seized power because of the cowardice of pathetic democratic governments that could not stand against them. The time is upon us to create the organizations that can lead a new way forward. We have the technology, and we have the will power–now we must organize. Over the coming years we will find one another in the streets, and on digital forums spread through cyberspace. We will organize from the shadows, and will strike out viciously from the night, only to abscond back into the digital sphere where we are Sovereign. Using the powerful ideology of revolutionary syndicalism we can create the digital-political organizations that shall allow for us to break the state, crush their capitalist allies, and build a new way forward. We openly declare that our ends can be attained only by the subversive overthrow of all existing social conditions through the empowerment of all people within the digital sphere. Let the ruling classes tremble at the revolutionary power of bitcoin, the personal empowerment of privacy through crypto, and the auto-didactic nature of the internet itself. There is nothing to left to lose but our chains, and there is a whole world to liberate.

The time is upon us to create the organizations that can lead a new way forward. We have the technology, and we have the will power–now we must organize. Over the coming years we will find one another in the streets, and on digital forums spread through cyberspace. We will organize from the shadows, and will strike out viciously from the night, only to abscond back into the digital sphere where we are Sovereign. Using the powerful ideology of revolutionary syndicalism we can create the digital-political organizations that shall allow for us to break the state, crush their capitalist allies, and build a new way forward. We openly declare that our ends can be attained only by the subversive overthrow of all existing social conditions through the empowerment of all people within the digital sphere. Let the ruling classes tremble at the revolutionary power of bitcoin, the personal empowerment of privacy through crypto, and the auto-didactic nature of the internet itself. There is nothing to left to lose but our chains, and there is a whole world to liberate.

“I insist that it is not the handful of parasites [of capitalism and the state], but the mass itself is responsible for this horrible state of affairs. It clings to its masters, loves the whip, and is the first to cry Crucify! the moment a protesting voice is raised against the sacredness of capitalistic authority or any other decayed institution. Yet how long would authority and private property exist, if not for the willingness of the mass to become soldiers, policemen, jailers, and hangmen. The Socialist demagogues know that as well as I, but they maintain the myth of the virtues of the majority, because their very scheme of life means the perpetuation of power. And how could the latter be acquired without numbers? Yes, power, authority, coercion, and dependence rest on the mass, but never freedom, never the free unfoldment of the individual, never the birth of a free society.” –Emma Goldman

“I insist that it is not the handful of parasites [of capitalism and the state], but the mass itself is responsible for this horrible state of affairs. It clings to its masters, loves the whip, and is the first to cry Crucify! the moment a protesting voice is raised against the sacredness of capitalistic authority or any other decayed institution. Yet how long would authority and private property exist, if not for the willingness of the mass to become soldiers, policemen, jailers, and hangmen. The Socialist demagogues know that as well as I, but they maintain the myth of the virtues of the majority, because their very scheme of life means the perpetuation of power. And how could the latter be acquired without numbers? Yes, power, authority, coercion, and dependence rest on the mass, but never freedom, never the free unfoldment of the individual, never the birth of a free society.” –Emma Goldman “But how does it work?”

“But how does it work?” “War is Peace!

“War is Peace!

It’s about power

It’s about power We are the Vanguard of bitcoin. We are the ones who shall fight the Goliath of Finance and the Leviathan of the State and watch them fall from the pedestal of human they mounted themselves upon. We shall watch them fall, we shall watch them burn, and we will do nothing but stoke the flames. We will do simply laugh and walk away, disengaging them and continuing to build the new economy that is based upon the values and virtues that has been put into the code.

We are the Vanguard of bitcoin. We are the ones who shall fight the Goliath of Finance and the Leviathan of the State and watch them fall from the pedestal of human they mounted themselves upon. We shall watch them fall, we shall watch them burn, and we will do nothing but stoke the flames. We will do simply laugh and walk away, disengaging them and continuing to build the new economy that is based upon the values and virtues that has been put into the code. Freedom.

Freedom. Smashing Monopolies with Advanced Technology

Smashing Monopolies with Advanced Technology It is not by augmenting the capital of the country, but by rendering a greater part of that capital active and productive than would otherwise be so, that the most judicious operations of banking can increase the industry of the country. That part of his capital which a dealer is obliged to keep by him unemployed and in ready money, for answering occasional demands, is so much dead stock, which, so long as it remains in this situation, produces nothing, either to him or to his country. The judicious operations of banking enable him to convert this dead stock into active and productive stock; into materials to work upon; into tools to work with; and into provisions and subsistence to work for; into stock which produces something both to himself and to his country.”

It is not by augmenting the capital of the country, but by rendering a greater part of that capital active and productive than would otherwise be so, that the most judicious operations of banking can increase the industry of the country. That part of his capital which a dealer is obliged to keep by him unemployed and in ready money, for answering occasional demands, is so much dead stock, which, so long as it remains in this situation, produces nothing, either to him or to his country. The judicious operations of banking enable him to convert this dead stock into active and productive stock; into materials to work upon; into tools to work with; and into provisions and subsistence to work for; into stock which produces something both to himself and to his country.”

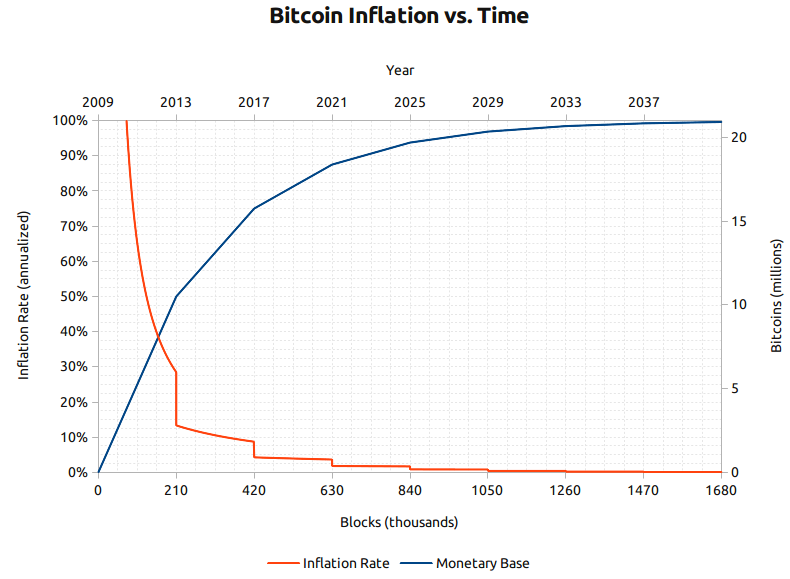

For this post I am going to pretend that bitcoins are real coins that are minted from a new metal called Satoshium. This metal is ugly, has few uses, and cannot be physically touched, as it is invisible–overall it is pretty useless. However this new metal is very, very divisible, malleable and it can be transported over any digital communication channel. All Satoshium that will ever comes into existence is created through the coinbase reward that ‘mints’ bitcoin units, which happens during the process of ‘bitcoin mining’.

For this post I am going to pretend that bitcoins are real coins that are minted from a new metal called Satoshium. This metal is ugly, has few uses, and cannot be physically touched, as it is invisible–overall it is pretty useless. However this new metal is very, very divisible, malleable and it can be transported over any digital communication channel. All Satoshium that will ever comes into existence is created through the coinbase reward that ‘mints’ bitcoin units, which happens during the process of ‘bitcoin mining’.

Satoshium is really the coinbase reward, which is the raw material that bitcoins are minted from (fun fact, the only way you can truly destroy a bitcoin is through not claiming the full coinbase reward). In the same manner that gold is just a hunk of metal before it is minted into a coin; so is satoshium is to bitcoin. When someone is rewarded for satoshium mining, those satoshium units are grouped into chunks of 100 million units and ‘minted’ single bitcoin. This is the coinbase reward process. This ‘mints’ satoshium units into bitcoins based upon what the block reward is at that time, and pays that reward of new coins out to a new bitcoin address. This is the ‘minting’ process and how the bitcoin network creates new bitcoins.

Satoshium is really the coinbase reward, which is the raw material that bitcoins are minted from (fun fact, the only way you can truly destroy a bitcoin is through not claiming the full coinbase reward). In the same manner that gold is just a hunk of metal before it is minted into a coin; so is satoshium is to bitcoin. When someone is rewarded for satoshium mining, those satoshium units are grouped into chunks of 100 million units and ‘minted’ single bitcoin. This is the coinbase reward process. This ‘mints’ satoshium units into bitcoins based upon what the block reward is at that time, and pays that reward of new coins out to a new bitcoin address. This is the ‘minting’ process and how the bitcoin network creates new bitcoins.

Bitcoin is a commodity money because the cryptography that bitcoin is built on top of. This has created the contract that limits the supply of bitcoin units and protects the bitcoin payment network. It is cryptography that creates the immutable and fungibility of bitcoin units and the imperium of the bitcoin network. This immutability creates a use-value for bitcoin, which also creates its exchange value. Furthermore, the ‘satoshium’ units of bitcoin can be broken down and used for all sort of other various contractual functions. By understanding bitcoin as a commodity money, we can see the true value that bitcoin has is outside of the legal constructs of the state.

Bitcoin is a commodity money because the cryptography that bitcoin is built on top of. This has created the contract that limits the supply of bitcoin units and protects the bitcoin payment network. It is cryptography that creates the immutable and fungibility of bitcoin units and the imperium of the bitcoin network. This immutability creates a use-value for bitcoin, which also creates its exchange value. Furthermore, the ‘satoshium’ units of bitcoin can be broken down and used for all sort of other various contractual functions. By understanding bitcoin as a commodity money, we can see the true value that bitcoin has is outside of the legal constructs of the state. To understand Bitcoin, we need to also understand the history of money. This is a long and complex topic that has changed dramatically over the last 400 years, and has a total history of more than 3000 years. In order to understand both money, and bitcoin, we need to understand that there are two distinct functions that money has, that are independent of each other, but both influences money’s value: the payment function of money, and its storage of value function.

To understand Bitcoin, we need to also understand the history of money. This is a long and complex topic that has changed dramatically over the last 400 years, and has a total history of more than 3000 years. In order to understand both money, and bitcoin, we need to understand that there are two distinct functions that money has, that are independent of each other, but both influences money’s value: the payment function of money, and its storage of value function. near the end of WWII, the allies came together in secret meeting in Bretton Woods to negotiate how the new global economy would be built. Keynes wanted an

near the end of WWII, the allies came together in secret meeting in Bretton Woods to negotiate how the new global economy would be built. Keynes wanted an

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”