Digital currencies are a new form of economic organization that exist entirely outside of the reach of the State. This has far-reaching ramification not just for money and capitalism, but for the ideological super-structure of the world today. Forcing concepts like exchange and economics into a theorem where tangibility is no longer needed causes for an unraveling of the state power structure itself. Institutionalized violence is no longer prerequisite for the monetary and legal system to function.

Digital currencies are a new form of economic organization that exist entirely outside of the reach of the State. This has far-reaching ramification not just for money and capitalism, but for the ideological super-structure of the world today. Forcing concepts like exchange and economics into a theorem where tangibility is no longer needed causes for an unraveling of the state power structure itself. Institutionalized violence is no longer prerequisite for the monetary and legal system to function.

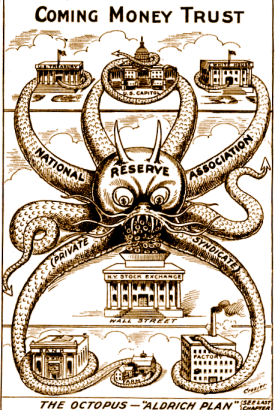

The ideological structure of capitalism has embedded itself into the state via the legal system. The State then acts as a thug on behalf of capitalist by enforcing laws through means of legalized repression and violence. It is from this proof-of-violence concept that states are able to force people to accept the legitimacy of contracts, the law, and the value of fiat money at the point of a knife. If governments could not the violence of their legal systems to enforce the acceptance of fiat money, or the repayment of debt; the entire international monetary system would collapse overnight.

Sovereignty of Value and Legal Ideology

All contemporary forms of fiat money rely on the physical and legal enforcement of laws, and the monopolization of the payment systems in order to create exchange value. All state money systems operate on maxims of restrictions based in law, enforced with mystical propaganda in one hand, and a clenched fist of enforcement in the other. The propaganda that is used to convince people of the need for the State to control money is far more important than the laws that create that money, or the guns and violence that are used to enforce their value. It is only through the repressive apparatuses of the State, and the cooperation of their capitalist allies that allows for this system of fiat money to continue to hold value.

Legal restrictions create the nominal values of the currency bills from all states. It is the same for the EU’s Euro, the Chinese Yuan, or Malaysian Ringgit–the currencies have nominal, redeemable value for goods and services in those Nation-States (or unions), and not outside them.

The value of these national currencies are created explicitly from the monopolization of the payment systems, and the monopolization of the issuance of legal tender. The monopoly of money itself via legal tender, and the monopolization of the payment system by the banks working with the state, is how national currencies forces themselves into a means of value, unlike commodity-monies like gold, sliver, or bitcoin.

The value of fiat money is unnatural and is only create through legal force. The power to create fiat money exist solely in the legal realm. However, what forces them to have value is the violence in which the laws based around those nominal values function. There is no such law to make commodities into money; they are simply valued. Mises surmises this in the appendix of “The Theory of Money and Credit,”

Ludwig von Mises

“Another acatallactic doctrine seeks to explain the value of money by the command of the state. According to this theory the value of money rests on the authority of the highest civil power, not on the estimation of commerce. The law commands, the subject obeys. This doctrine can in no way be fitted into a theory of exchange; for apparently it would have a meaning only if the state fixed the actual level of the money prices of all economic goods and services as by means of general price regulation. Since this cannot be asserted to be the case, the state theory of money is obliged to limit itself to the thesis that the state command establishes only the Geltung or validity of the money in nominal units, but not the validity of these nominal units in commerce. But this limitation amounts to abandonment of the attempt to explain the problem of money. By stressing the contrast between valor impositus and bonitas intrinseca, the canonists did indeed make it possible for scholastic sophistry to reconcile the Roman-canonist legal system with the facts of economic life. But at the same time they revealed the intrinsic futility of the doctrine of valor impositus; they demonstrated the impossibility of explaining the processes of the market with its assistance.”

This difference between valor impositus and bonitas intrinseca: the nominal value of units imposed by the state–such as the dollar or shekel–and that which holds real intrinsic value; such as the metals, minerals, or other storage of value.

The best example of how these two values act against one another would be a gold coin that has a lower face value than what the coin is worth on the open market–it is not the stamping of the metal that creates value, but the amount of gold that it is comprised of.

Mises spoke further of the historical difference between the nominal value of coins, and their weight as metal:

“Nevertheless, in defiance of all official regulations and prohibitions and fixing of prices and threats of punishment, commercial practice has always insisted that what has to be considered in valuing coins is not their face value but their value as metal. The value of a coin has always been determined, not by the image and superscription it bears nor by the proclamation of the mint and market authorities, but by its metal content. Not every kind of money has been accepted at sight, but only those kinds with a good reputation for weight and fineness. In loan contracts, repayment in specific kinds of money has been stipulated for, and in the case of a change in the coinage, fulfillment in terms of metal required. In spite of all fiscal influences, the opinion gradually gained general acceptance, even among the jurists, that it was the metal value—the bonitas intrinseca as they called it—that was to be considered when repaying money debts.” Part 1, Chapter 3

Today because of the structure of late capitalism, where the state monopolizes the currency, and the banks monopolize the exchange of currency, there is no way to demand repayment in anything other than more fiat. It is from the insidious brilliance of forcing all exchanges into legal structures with no alternative payment forms, that fiat money both creates its own value, and also becomes a legal power.

We can see that money today is not valued because of its bonitas intrinseca, but only its valor impositus. This means that the only way that the state can make its money hold value is through explicit legal means, which are reliant on repressive legal enforcement, and nothing else.

Physical World Against Digital Laws

There is a glaring issue with this mode of money creation when we start to consider for a moment that the world that we live no longer is orchestrated by legal enforcement of the state, but digital communications.

There is no physical footing in this world, no place for the apparatus to establish itself.The repressive violence states use to enforce their laws simply cannot exist here.

If we return to Foucault in Truth and Power he provides us with more hints about the functions of the state and why ‘cutting off the king’s head’ has been impossible until recently:

Moderator: The King’s head still hasn’t been cut off, yet already people are trying to replace it by discipline, that vast system instituted’-in the seventeenth century comprising the functions of surveillance, normalization and control and, a little later, those of punishment, correction, education and so on. One wonders where this system comes from, why it emerges and what its use is. And today there is rather a tendency to attribute a subject to it, a great, molar, totalitarian subject, namely the modern State, constituted in the sixteenth and seventeenth centuries and bringing with it (according to the classical theories) the professional army, the police and the administrative bureaucracy.

Foucault: To pose the problem in terms of the State means to continue posing it in terms of sovereign and sovereignty, that is to say in terms of law. If one describes all these phenomena of power as dependent on the State apparatus, this means grasping them as essentially repressive: the Army as a power of death, police and justice as punitive instances, etc. I don’t want to say that the State isn’t important; what I want to say is that relations of power, and hence the analysis that must be made of them, necessarily extend beyond the limits of the State. In two senses: first of all because the State, for all the omnipotence of its apparatuses, is far from being able to occupy the whole field of actual power relations, and further because the State can only operate on the basis of other, already existing power relations. The State is superstructural in relation to a whole series of power networks, that invest the body, sexuality, the family, kinship, knowledge, technology and so forth. True, these networks stand in a conditioning-conditioned relationship to a kind of ‘meta-power’ which is structured essentially round a certain number of great prohibition functions; but this meta-power with its prohibitions can only take hold and secure its footing where it is rooted in a whole series of multiple and indefinite power relations that supply the necessary basis for the great negative forms of power. That, is just what I was trying to make apparent in my book [“The Order of Things” which was originally titled “Words and Things.”].

Foucault: To pose the problem in terms of the State means to continue posing it in terms of sovereign and sovereignty, that is to say in terms of law. If one describes all these phenomena of power as dependent on the State apparatus, this means grasping them as essentially repressive: the Army as a power of death, police and justice as punitive instances, etc. I don’t want to say that the State isn’t important; what I want to say is that relations of power, and hence the analysis that must be made of them, necessarily extend beyond the limits of the State. In two senses: first of all because the State, for all the omnipotence of its apparatuses, is far from being able to occupy the whole field of actual power relations, and further because the State can only operate on the basis of other, already existing power relations. The State is superstructural in relation to a whole series of power networks, that invest the body, sexuality, the family, kinship, knowledge, technology and so forth. True, these networks stand in a conditioning-conditioned relationship to a kind of ‘meta-power’ which is structured essentially round a certain number of great prohibition functions; but this meta-power with its prohibitions can only take hold and secure its footing where it is rooted in a whole series of multiple and indefinite power relations that supply the necessary basis for the great negative forms of power. That, is just what I was trying to make apparent in my book [“The Order of Things” which was originally titled “Words and Things.”].

To cut off the king’s head we must venture into a realm where a footing for his power cannot be found. A realm where the physical violence, repression, and thus the capacity to physical enforce nationalistic laws cannot exist. The meta-power of the state and their various laws end where they do–in physical territory, in a physical world. There is no need to cut the heads off of false prophets whom we are immune to.

Digital sovereignty departs from the theology of law, and builds a new economic system that operates from a critical bias of math, instead of physical enforcement. These systems are based upon non-physical knowledge alone (knowledge of the private key), which means these systems are built solely around their mathematical soundness. The code upon which these currencies are written is their own sovereign valor impositus. The computer code itself is the legal-mathematical structure that enforces the rules of bitcoin, and other digital currencies–no State or third-party is needed.

Digital Sovereign and The Banishment of Physical Force

Digital currencies are the kernel of power that a new economic and legal superstructure will be built from. Power is no longer something that comes from the sword, but from the pen.

Violence cannot be an explicit tool of enforcement or appropriation in a nearly-anonymous, digital system like bitcoin or other digital currencies. Economic independence outside of the control of the state or the banks is now a real possibility. This severely underminds the power of the State, the banks, and state-capitalism in total. Digital currencies allow for a new frontier of economic freedom and independence, that is not achievable with the current monetary and legal systems. With bitcoin, people are free to choose who they conduct transactions with, without the permission of the state, banks, or the violence they use to enforce their laws.

When we start to critically assess the current money systems of the world, along with the ideological and mythical structures of sovereignty, law, and the state; we find that they quickly break down under scrutiny. We come to understand that the dominion of the ideologies over our lives is not based upon some holy, progressive knowledge that protects us and gives us salvation; rather, it is barbarism wrapped in blanket, upon blanket of lies, obfuscations, and deceptions.

We see that it is not magnanimity or justice that governs the actors of the State; but selfishness, greed, corruption, and cowardice. We come to see the world as Angelus Novus did, and the horrors of what is stacked in front of us and growing with each passing day. To make whole that which has been smashed is possible, but we must wake the dead in our quest for redemption. The gate is strait, and it is our duty to show others the liberation that can come with each passing second.

In the declaration of independence of cyberspace we declared our virtual selves immune to state sovereignty, even as we continue to consent to the subjugation of our bodies. In the mean while we have spread to every corner of the global to ensure that our thoughts cannot be arrested, and so that the crimes of the state and capitalism will be seen by all, for all of history to come.

We now have the means to reappropriate our sovereignty, our economic independence, and ultimately our political organizations and the State itself. This can and will be done to end the era of state-capitalism, and usher in a new era of global digital organization. We are creating a civilization of the Mind in Cyberspace, and using digital currencies to economically unite us is the first step towards this new world.

—

Next: Bitcoin as a Commodity Money

Bitcoin and digital currencies will always be a cheaper monetary systems to maintain and utilize than a fiat money, partially when we consider the cost of scaling and security over the long-term, and on a global scale. Due to the unique construction of digital currencies from a security stand point, digital currencies create nearly perfectly secure money systems at rest. Out of the box, through cryptographic functionalities built directly into digital currency protocols; they are magnitudes more secure, efficient, and scalable than fiat money. Fiat money must be defended from counter-fitting, banking fraud, note destruction, and physical theft. Fiat money will always be more expensive to service, use, and maintain as a whole monetary system than any kind of digital currency system because of those weaknesses and flaws. Digital currencies have greater security and scalability than their fiat counterparts as well.

Bitcoin and digital currencies will always be a cheaper monetary systems to maintain and utilize than a fiat money, partially when we consider the cost of scaling and security over the long-term, and on a global scale. Due to the unique construction of digital currencies from a security stand point, digital currencies create nearly perfectly secure money systems at rest. Out of the box, through cryptographic functionalities built directly into digital currency protocols; they are magnitudes more secure, efficient, and scalable than fiat money. Fiat money must be defended from counter-fitting, banking fraud, note destruction, and physical theft. Fiat money will always be more expensive to service, use, and maintain as a whole monetary system than any kind of digital currency system because of those weaknesses and flaws. Digital currencies have greater security and scalability than their fiat counterparts as well. Payment and storage of value systems are huge social networks of economic acceptance. This is why new, crisp $100 bills are accepted almost anywhere in the world due to the economic hegemony of the U.S. dollar. However, there is nothing in the dollar bills themselves that have true value; just that the next person who gets that bill will know that it is worth $100–a relatively stable value against many local currencies like the Venusalian Bolivar, or the Argentinian Peso, which have both experienced bouts of hyperinflation.

Payment and storage of value systems are huge social networks of economic acceptance. This is why new, crisp $100 bills are accepted almost anywhere in the world due to the economic hegemony of the U.S. dollar. However, there is nothing in the dollar bills themselves that have true value; just that the next person who gets that bill will know that it is worth $100–a relatively stable value against many local currencies like the Venusalian Bolivar, or the Argentinian Peso, which have both experienced bouts of hyperinflation. Due to a condition that is similar to undercover interest rate parity, digital currencies will always offer an opportunity for profit over fiat. This is not due to an actual higher interest rate of digital currencies, but due to an increase in the demand for digital currencies over the total available, fixed, known supply. This causes for value appreciation of digital currencies as demand outstrips the limited supply. What gives digital currencies their distinct advantage over fiat is that the networks is that the money supply cannot be inflated at will. This creates an unmailable supply which is nearly impossible to change, unlike all fiat monies.

Due to a condition that is similar to undercover interest rate parity, digital currencies will always offer an opportunity for profit over fiat. This is not due to an actual higher interest rate of digital currencies, but due to an increase in the demand for digital currencies over the total available, fixed, known supply. This causes for value appreciation of digital currencies as demand outstrips the limited supply. What gives digital currencies their distinct advantage over fiat is that the networks is that the money supply cannot be inflated at will. This creates an unmailable supply which is nearly impossible to change, unlike all fiat monies.

It’s about power

It’s about power We are the Vanguard of bitcoin. We are the ones who shall fight the Goliath of Finance and the Leviathan of the State and watch them fall from the pedestal of human they mounted themselves upon. We shall watch them fall, we shall watch them burn, and we will do nothing but stoke the flames. We will do simply laugh and walk away, disengaging them and continuing to build the new economy that is based upon the values and virtues that has been put into the code.

We are the Vanguard of bitcoin. We are the ones who shall fight the Goliath of Finance and the Leviathan of the State and watch them fall from the pedestal of human they mounted themselves upon. We shall watch them fall, we shall watch them burn, and we will do nothing but stoke the flames. We will do simply laugh and walk away, disengaging them and continuing to build the new economy that is based upon the values and virtues that has been put into the code. Freedom.

Freedom. Digital currencies are a new form of economic organization that exist entirely outside of the reach of the State. This has far-reaching ramification not just for money and capitalism, but for the ideological super-structure of the world today. Forcing concepts like exchange and economics into a theorem where tangibility is no longer needed causes for an unraveling of the state power structure itself. Institutionalized violence is no longer prerequisite for the monetary and legal system to function.

Digital currencies are a new form of economic organization that exist entirely outside of the reach of the State. This has far-reaching ramification not just for money and capitalism, but for the ideological super-structure of the world today. Forcing concepts like exchange and economics into a theorem where tangibility is no longer needed causes for an unraveling of the state power structure itself. Institutionalized violence is no longer prerequisite for the monetary and legal system to function.

Foucault: To pose the problem in terms of the State means to continue posing it in terms of sovereign and sovereignty, that is to say in terms of law. If one describes all these phenomena of power as dependent on the State apparatus, this means grasping them as essentially repressive: the Army as a power of death, police and justice as punitive instances, etc. I don’t want to say that the State isn’t important; what I want to say is that relations of power, and hence the analysis that must be made of them, necessarily extend beyond the limits of the State. In two senses: first of all because the State, for all the omnipotence of its apparatuses, is far from being able to occupy the whole field of actual power relations, and further because the State can only operate on the basis of other, already existing power relations. The State is superstructural in relation to a whole series of power networks, that invest the body, sexuality, the family, kinship, knowledge, technology and so forth. True, these networks stand in a conditioning-conditioned relationship to a kind of ‘meta-power’ which is structured essentially round a certain number of great prohibition functions; but this meta-power with its prohibitions can only take hold and secure its footing where it is rooted in a whole series of multiple and indefinite power relations that supply the necessary basis for the great negative forms of power. That, is just what I was trying to make apparent in my book [“The Order of Things” which was originally titled “Words and Things.”].

Foucault: To pose the problem in terms of the State means to continue posing it in terms of sovereign and sovereignty, that is to say in terms of law. If one describes all these phenomena of power as dependent on the State apparatus, this means grasping them as essentially repressive: the Army as a power of death, police and justice as punitive instances, etc. I don’t want to say that the State isn’t important; what I want to say is that relations of power, and hence the analysis that must be made of them, necessarily extend beyond the limits of the State. In two senses: first of all because the State, for all the omnipotence of its apparatuses, is far from being able to occupy the whole field of actual power relations, and further because the State can only operate on the basis of other, already existing power relations. The State is superstructural in relation to a whole series of power networks, that invest the body, sexuality, the family, kinship, knowledge, technology and so forth. True, these networks stand in a conditioning-conditioned relationship to a kind of ‘meta-power’ which is structured essentially round a certain number of great prohibition functions; but this meta-power with its prohibitions can only take hold and secure its footing where it is rooted in a whole series of multiple and indefinite power relations that supply the necessary basis for the great negative forms of power. That, is just what I was trying to make apparent in my book [“The Order of Things” which was originally titled “Words and Things.”]. Here is an

Here is an  Though there are many internet cultural groups today, the original ‘internet culture’ would be the cypherpunks. From the cypherpunks came publications like, “

Though there are many internet cultural groups today, the original ‘internet culture’ would be the cypherpunks. From the cypherpunks came publications like, “

Through the education system we are taught that governments are good, and the world works the way it does for good reason. We learn from this system that economist can explain why the economy functions as it does, and why we all must work hard to take home our day’s pay. Included in this ideology is the notion that our noble business leaders, who lift the world upon their shoulders, are entitled to a king’s share of the wealth for directing his firm to make a profit; even if this is at the expense of many.

Through the education system we are taught that governments are good, and the world works the way it does for good reason. We learn from this system that economist can explain why the economy functions as it does, and why we all must work hard to take home our day’s pay. Included in this ideology is the notion that our noble business leaders, who lift the world upon their shoulders, are entitled to a king’s share of the wealth for directing his firm to make a profit; even if this is at the expense of many. Bitcoin is a radical new technology that we do not fully understand the impact of quite just yet, and most likely, we will not for years to come. As this economy grows, evolves, and has more market participants, the itching question is, how will this affect the political situations of the world? At first glance bitcoin may not seem like much at all, but when you look at bitcoin through the lens that it is independent wealth controlled by no nation-state, there are some interesting questions that are called into play.

Bitcoin is a radical new technology that we do not fully understand the impact of quite just yet, and most likely, we will not for years to come. As this economy grows, evolves, and has more market participants, the itching question is, how will this affect the political situations of the world? At first glance bitcoin may not seem like much at all, but when you look at bitcoin through the lens that it is independent wealth controlled by no nation-state, there are some interesting questions that are called into play. “Bills of attainder, ex post facto laws, and laws impairing the obligations of contracts, are contrary to the first principles of the social compact, and to every principle of sound legislation. … The sober people of America are weary of the fluctuating policy which has directed the public councils. They have seen with regret and indignation that sudden changes and legislative interference, in cases affecting personal rights, become jobs in the hands of enterprising and influential speculators, and snares to the more-industrious and less-informed part of the community.” —James Madison

“Bills of attainder, ex post facto laws, and laws impairing the obligations of contracts, are contrary to the first principles of the social compact, and to every principle of sound legislation. … The sober people of America are weary of the fluctuating policy which has directed the public councils. They have seen with regret and indignation that sudden changes and legislative interference, in cases affecting personal rights, become jobs in the hands of enterprising and influential speculators, and snares to the more-industrious and less-informed part of the community.” —James Madison

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

There are several features that create the intrinsic value of bitcoin, but the primary one is its production cost. Bitcoin is a commodity money like gold, sliver, or copper which means that the energy cost to extract these raw materials creates their base value. The actual exchange between two people is totally subjective, as the

There are several features that create the intrinsic value of bitcoin, but the primary one is its production cost. Bitcoin is a commodity money like gold, sliver, or copper which means that the energy cost to extract these raw materials creates their base value. The actual exchange between two people is totally subjective, as the