I frequently diatribe against capitalism in this blog, and in the following homily I would like to offer my perspective on the difference between capitalist and entrepreneurs:

Entrepreneurs and capitalists are two fundamentally different sides of the process of creative destruction that is found in capitalism. On one side there is the ubermensch of entrepreneurship; the heroic and controversial figures who indelibly advances technology through destroying the old ways. On the opposite side are the reactionary capitalist; fearful men of wealth and old ways, who demand a guaranteed return on investment from the state, at the cost of progress for all. It is in the arena of the market the these forces of old and new meet; clashing to see who will be the victor for that day and time. The stadium they meet in is filled with the people of the market; the masses and workers of all type; who are there for the spectacle of the competition, but who also affect the outcome through whom they choose to support in this clash between old and new.

Ubermensch Entrepreneurs

Entrepreneurs are the heros of the incessant revolution that we call progress. They are the champions that take on behemoth risks, and are the ones that put their livelihood at stake in order to see progress in their field of choice. These are the men who choose to be Atlas in our time, and lift the world upon their shoulders to carry us all towards their new vision of the world–even if we do not like it. These are the people who engage in the creative destruction of capitalism, not for the sake of profits, but to create progress.

Entrepreneurs are motivated to change the old order and to recreate that which they seek to destroy in a more productive, profitable, and technologically advanced way. Entrepreneurs are the captains of the ships, the composer of the shows, and the powerful leaders who must motivate and rally the support in order to manifest their vision that shall shift the globe on its axis. They are the ones who insist that the world shall change; and they shall be the ones who demand it. They shall not be relegated to perpetuate old, anachronistic ways of doing things for the profits of another; they choose to create for themselves, or to die trying. It is from the impassioned zeal of the entrepreneur that they are able to recruit loyal followers who will commit to the struggle towards the entrepreneur’s vision of the world.

The Man in the Arena

As the single naked man steps into the arena, in front of the whole world to display his prowls of economy combat, he is insignificant; pathetic and inept looking in front of the Goliath of the state; their reigning champion of the market. Here, in the silence before the fight, the entrepreneur takes a deep breath, armed with his superior product and technology; smugly grinning to himself, for he knowns the greatness that shall come in the following clash:

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better.

The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.”

–Theodore Roosevelt, Citizenship in the Republic

Workers and the Masses of the Crowd

Torn between this world of entrepreneurs and capitalist, are the workers and the masses. It is the masses for whom the entire battle is fought for; and yet they shall never enter into the arena, and many may never even see the fight. Wholly unbeknowst to them, they are the true arbitrators of who shall be the winner, and direct the outcome through whom they cheer for. It is in this spectacle of the arena that the masses make their choice of whom they shall win: The heroic underdog entrepreneur, or the current champion of the status quo.

The entrepreneurs who chooses to enters the arena must have the crowd cheering and support them. It is from them, the crowd, from which he is able to summon the strength to become the ubermensch of that time; to raise from the crowd the will to power for progress. It is from them that the entrepreneur can find the morale to fight in the arena of the market against all odd. It is from gaining their support, loyalty, and convictions that the entrepreneur can stand to fight against the Goliath. Using his wit, cunning, superior technology, and support from the people to beat back the demon of the past, it is He that shall create the opening for a future of change.

The entrepreneurs who chooses to enters the arena must have the crowd cheering and support them. It is from them, the crowd, from which he is able to summon the strength to become the ubermensch of that time; to raise from the crowd the will to power for progress. It is from them that the entrepreneur can find the morale to fight in the arena of the market against all odd. It is from gaining their support, loyalty, and convictions that the entrepreneur can stand to fight against the Goliath. Using his wit, cunning, superior technology, and support from the people to beat back the demon of the past, it is He that shall create the opening for a future of change.

It is here in the arena that the clash against the current champion of the markets is had. The state, the corporate oligarchs, and all of their allies support the Goliath with everything they can, and will conduct a war from the stands by other means. They will use propaganda, create arena rules that serve the incumbent champions, directly sabotage matches, and outright cheating–the state and the capitalist will do everything to ensure their champions of the market remains. With nearly insurmountable odds against the entrepreneur, he steps into the arena, fully aware of the battle that is against him is despondently unfair.

Armed with his revolutionary cause to create change, to smash the very essences of which he fights against, the entrepreneur steps into the ring with the smile of a man ready to meet death. It is from this kind of leadership, passion, and geist that he inspires others break away from their cubical prisons of meaningless dullness and drab, into a free world of harder work by ones own choosing. He inspires men to toil under his yoke for the convictions for which he plows. The men who choose to join him shall not be granted a 401K, or the safety of permanence, but they shall be given his respect, and a portion of his ship for helping him build such a vision.

Reactionary Incumbent Capitalist

Ca pitalist are scum that do everything in their power to halt progress every step of the way. They are the cowardly parasites that hide behind that jackets of politicians like scare children; begging for their protection, and the oppression of anyone who challenges them. Their interested extends only to their families, friends, cronies, and kickbacks; at the direct expense of everyone else. Morals, ethics, and purpose are concepts that are completely foreign to capitalist–the profit motive is the only thing that matters to them. The capitalist masquerade with phony, transparent, vulgar ideology that makes little sense, but nevertheless sever as slogans and political stances that can be passed out to the masses as candy. The capitalist, like monopolist, oligopolist, and fascist, believe themselves to be entitled to whatever they may be able to forceable extract from others under the manipulated and corrupt laws of the sovereign.

pitalist are scum that do everything in their power to halt progress every step of the way. They are the cowardly parasites that hide behind that jackets of politicians like scare children; begging for their protection, and the oppression of anyone who challenges them. Their interested extends only to their families, friends, cronies, and kickbacks; at the direct expense of everyone else. Morals, ethics, and purpose are concepts that are completely foreign to capitalist–the profit motive is the only thing that matters to them. The capitalist masquerade with phony, transparent, vulgar ideology that makes little sense, but nevertheless sever as slogans and political stances that can be passed out to the masses as candy. The capitalist, like monopolist, oligopolist, and fascist, believe themselves to be entitled to whatever they may be able to forceable extract from others under the manipulated and corrupt laws of the sovereign.

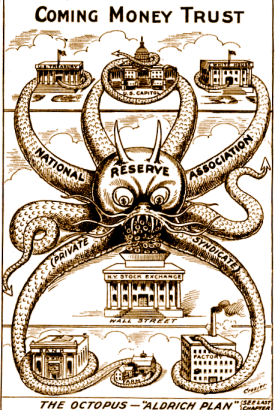

Capitalist love the law, the state, and most especially the police. For it is the state who protects the capitalist scum, who defends their every move, makes excuses for their human rights abuse, and most importantly, offers an excuse for the justification for the unholy destruction of the natural world in the name of a prophet called Profit. It is the state who protects these evil men from the knives of justice, and who allows for them to exploit countless untold souls for little more than 30 pieces of silver. The capitlist love the state more than profit, for they know that it is the state who allows for them to create the world as it is–The State is the one true god of the capitalist.

The Capitalist never sully their hands with the hard work of battle that the entrepreneur faces in the arena. They may have risen though the ranks of the arena, but once they join the upper echelons of society, there is no need for such, ‘theatrics’ as fighting in the arena. Their battle was won long ago by other means, and now they believe they are entitled to the pedestal upon which they have mounted themselves. From here there is no need to work or fight–the work is for the proles, and the fighting is for the mercenaries–no need to life a fat finger when one has the power of capital.

This is where we can see the quintessential difference between the capitalist, and the entrepreneur. The capitalist is part of the system as it is now, and they would like to see it frozen in time. The monopolies and oligopolies that the capitalist have acquired for themselves are like the false champions whom they have helped stand in the arena: bought with dirty money, and made the victor not by strength or wit, but guile, and deception. The capitalist care not how the money is made, their only interest is in creating a return for themselves. They have no interest in the progress of man, and prefer a guaranteed return on investments–even if immoral–than to take on an abnormal risk to creating something profound. One would suspect that the profit motive would be their first motivational force, however, it cannot be. Prophets–profits of the capitalist kind–can only exist within the theology of the current economic, political and legal systems. One must offer their tithing of dollar and sense to the God of the State, along with the delirious conviction that the State commands all.

Everything and everyone can be bought and sold; including the laws themselves. This is how the battle for supremacy within the market has always been fought: on unfair terms, with unfair rules, created by an unfair system.

Weltgeist and The Will to Power

“I saw the Emperor – this weltgeist – riding out of the city on reconnaissance. It is indeed a wonderful sensation to see such an individual, who, concentrated here at a single point, astride a horse, reaches out over the world and masters it . . . this extraordinary man, whom it is impossible not to admire” –Georg Hegel

There is another type of man who cannot be shoved into the role of the capitalist or the entrepreneur of the arena. It is he who is the true champion; someone who is not known by the title of what they do, but rather, it is their being, their geist which can only be represented by their name. These are men like Ford, Carnegie, Tesla, Jobs, and many more; men who through their own personal zeal and drive to build something bigger, something different which could not be contained in the small confines of the arena. These are the men whom the venture capitalist (the entrepreneur of the world of capitalism) gather behind. The VCs have cashed out of the capitalism game and see the vision of the true lords of the market and arena: the men who forge progress.

These are the men who like Spartacus could not be relegated to be anything other than themselves. Men who propelled themselves to greatness not because of their role given to them; but because of the force that resided inside of them that demands greatness. It is here that the men who have chosen to become Gods smash out of the confines of any role given to them, and passionately build their own.

This is not from their arrogance, or haughtiness of their strength; but from the true power which commands them. These are the men who are driven to create a better world for all, and have the personal ability to manifest it because they are anointed with the power of the Weltgeist. These are the men who battle valiantly in the arena, not for the spectacle of the sport or to stand over the body of another; but so they may stand in that arena and point their sword towards the royal box, silently warning them of what is to come. These are men who fight not for the thrill of battle, but for their personal drive to create change. These are men who are willing to gamble it all, throwing caution into the wind so that they may stab towards destiny.

The entrepreneur is the ubermensch of economics; he is the one that rises to the occasion and seizes the moment for himself not to make money, but to make progress. He is not a man of cool and calculated numbers, but of impassioned bold moves, striving towards the change that he demands to manifest in the world, or to fail spectacularly in his attempt. The entrepreneur is the radical that insists the old, ineffective, static version of what is now be destroyed in the name of something better. He is not doing this to become rich–any man can become rich with petty material things. He does this to become Great, to be the Ubermensch of our time.

Smashing Monopolies with Advanced Technology

Smashing Monopolies with Advanced Technology It is not by augmenting the capital of the country, but by rendering a greater part of that capital active and productive than would otherwise be so, that the most judicious operations of banking can increase the industry of the country. That part of his capital which a dealer is obliged to keep by him unemployed and in ready money, for answering occasional demands, is so much dead stock, which, so long as it remains in this situation, produces nothing, either to him or to his country. The judicious operations of banking enable him to convert this dead stock into active and productive stock; into materials to work upon; into tools to work with; and into provisions and subsistence to work for; into stock which produces something both to himself and to his country.”

It is not by augmenting the capital of the country, but by rendering a greater part of that capital active and productive than would otherwise be so, that the most judicious operations of banking can increase the industry of the country. That part of his capital which a dealer is obliged to keep by him unemployed and in ready money, for answering occasional demands, is so much dead stock, which, so long as it remains in this situation, produces nothing, either to him or to his country. The judicious operations of banking enable him to convert this dead stock into active and productive stock; into materials to work upon; into tools to work with; and into provisions and subsistence to work for; into stock which produces something both to himself and to his country.”

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.