In a recent New York Times Op-ed “Bits and Barbarism,” Paul Krugman resumed his bashing of bitcoin, gold, and everything that is not government issued money. He presents an idea of how bitcoin and gold are ‘barbaric’ forms of money because of the resources that are expended to obtain them, while government ability to create money is good because it can spend that money to create positive economic output. The irony of Paul’s argument is he completely fails to see the barbarism of the United States, its imperial military, and the way that government money creation empowers such barbarism. Paul wants for the government to be our savior, but fails to see that governments created the economic situation we are in today. Bitcoin provide an exit from this tyranny that men like Paul cannot see because of their entrenched position within the interest of the wealthy from atop his ivory towers.

In a recent New York Times Op-ed “Bits and Barbarism,” Paul Krugman resumed his bashing of bitcoin, gold, and everything that is not government issued money. He presents an idea of how bitcoin and gold are ‘barbaric’ forms of money because of the resources that are expended to obtain them, while government ability to create money is good because it can spend that money to create positive economic output. The irony of Paul’s argument is he completely fails to see the barbarism of the United States, its imperial military, and the way that government money creation empowers such barbarism. Paul wants for the government to be our savior, but fails to see that governments created the economic situation we are in today. Bitcoin provide an exit from this tyranny that men like Paul cannot see because of their entrenched position within the interest of the wealthy from atop his ivory towers.

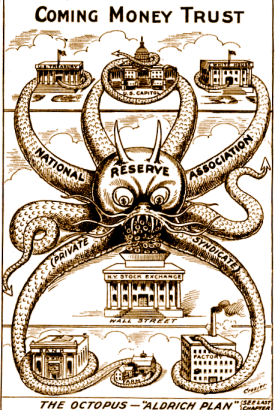

Paul thinks that the government has a serious vested interest in creating full employment and encouraging economic activity. However, when we look at the political-economic structure in this country, it is clear that something else is happening. In 2012 less than 32,000 people accounted for 28% of all political donations in 2012–that’s almost 0.01% of the population getting about 1/3 of the political voice of all the other voters combine. J.P. Morgan Chase, one of the richest companies in the world, has spent more than $100 million dollars on lobbying and political donations, and this has paid off for them handsomely. The International Monetary Fund estimates that J.P Morgan Chase receives about $14 billion dollars a year in subsidies–about 140x as much as they spent on political manipulation.

When we look at these figures we must understand that this is how the political system works. No amount of hope or objections will change that. Paul seems to think that creating positive economic change is simply about creating sufficient will power to create that change. He fails to see how the whole political system has been compromised by none other than the heroic government that he wants to see change it.

Now that we understand where Paul is coming from, we can address some of the points in his article.

Gold

Krugman opens his article with talking about the human rights violations that are occurs in gold mines, like the Porgera gold mine in Papua New Guinea. He then goes on to talk about how the desire for gold is to blame for such gross human rights violations, but fails to point out that this mine he mentioned is managed by the Canadian mining company Placer Dome. Paul seems to think that the western government of the world have some vested interest in preventing human rights violations. If that is so, than why would they not come down on companies that are facilitating it? To most of us it is pretty obvious–governments get kickbacks in the form of lobbying and political donations, in exchange for allowing large corporations to violate human rights abroad. It is disingenuous to talk about human rights violations, and then turn around and defend the governments that allow for those violations to occur.

Krugman opens his article with talking about the human rights violations that are occurs in gold mines, like the Porgera gold mine in Papua New Guinea. He then goes on to talk about how the desire for gold is to blame for such gross human rights violations, but fails to point out that this mine he mentioned is managed by the Canadian mining company Placer Dome. Paul seems to think that the western government of the world have some vested interest in preventing human rights violations. If that is so, than why would they not come down on companies that are facilitating it? To most of us it is pretty obvious–governments get kickbacks in the form of lobbying and political donations, in exchange for allowing large corporations to violate human rights abroad. It is disingenuous to talk about human rights violations, and then turn around and defend the governments that allow for those violations to occur.

Bitcoin

Paul then moves on to talk about how bitcoin mining engages in a similar wasted expenditure of energy similar to gold mining. He actually sounds like he really doesn’t understand how the block reward is distributed, which could be part of the problem. Paul does not understand the value of a P2P digital payment system that is out of the control of governments. He does not even see how it could have value. To him, bitcoin is just another commodity money like gold, which also should not have value.

This is critically important to understanding the elitist world view that Paul presents. Paul writes for the NYT, went to Yale for his undergrad, and M.I.T. for his Ph.d, and is a professor at Princeton. I’m sure that he has never been on the wrong side of the law, nor would he ever understand why you would be. He believe in the goodness of this government because he has always gotten the goodness of this government because of the elite position he occupies in society. Trying to tell him that maybe we need financial privacy because the government is proven to be corrupt and thieving doesn’t make sense to him–to him, these are the good guys, so why would you ever want a way to defend yourself from them?

Fiat

Paul then move on to talk about fiat money, and how in theory burying money and allowing for companies to struggle to extract the money would be a way to create real economic output. He uses this analogy to display that the extraction process of gold creates real economic output, in the same way that burying money could. He does this to show that the government can use their power of seigniorage (creating money from nothing) to create real economic output.

As true as this theory is, it is not the way that the governments have used their power of seigniorage. Instead this power has been used to give free money to the wealthiest organizations in the world: banks.

As true as this theory is, it is not the way that the governments have used their power of seigniorage. Instead this power has been used to give free money to the wealthiest organizations in the world: banks.

In Paul’s fantasy world, this is providing banks with the capital that they can then pass on to the little guy to create economic activity. What is really happening is the banks are just fattening themselves with free money in order to have the highest stock returns in recent history.

Government Role

Paul then moves on to quote Adam Smith on how gold and silver are ‘dead stocks’ to animate how wealth gets tied up in precious metals and then sits around doing nothing. What is very odd about this is if you read “The Wealth of Nations” you’ll see that this idea of gold and silver being a ‘dead stock’ is because gold and silver are hard to circulate. Smith saw paper money as being a technology–an innovation that allowed for all of the value of gold or silver to move about through a paper medium.

In many ways, bitcoin is the fusion of the ‘dead stock’ of precious metals, and the circulatory power of fiat money. Smith knew that gold and silver were the bases of the mercantilist world that he lived in, but he saw how damaging the hoarding of gold and silver was to the  wealth of the nation because it wasn’t doing anything. This is why he thought that paper money was a good–though imperfect–method of engaging the value of the gold and silver. Smith states,

wealth of the nation because it wasn’t doing anything. This is why he thought that paper money was a good–though imperfect–method of engaging the value of the gold and silver. Smith states,

“The judicious operations of banking, by substituting paper in the room of a great part of this gold and silver, enable the country to convert a great part of this dead stock into active and productive stock.”

Gold itself was not the problem, it was making gold into an active stock that could be used everyday that was the problem, and bitcoin solves this problem.

Near the end of the article Paul asks, “So why are we tearing up the highlands of Papua New Guinea to add to our dead stock of gold and, even more bizarrely, running powerful computers 24/7 to add to a dead stock of digits?” To me, this actually displays Paul’s lack of understand of how bitcoin works, because unlike gold, bitcoin is not a ‘dead stock.’ It is clearly used as a medium of exchange, while at the same time being storage of value, hence fusing the idea of how fiat money and gold have classically worked.

Paul concludes the article with this:

Talk to gold bugs and they’ll tell you that paper money comes from governments, which can’t be trusted not to debase their currencies. The odd thing, however, is that for all the talk of currency debasement, such debasement is getting very hard to find. It’s not just that after years of dire warnings about runaway inflation, inflation in advanced countries is clearly too low, not too high. Even if you take a global perspective, episodes of really high inflation have become rare. Still, hyperinflation hype springs eternal.

Bitcoin seems to derive its appeal from more or less the same sources, plus the added sense that it’s high-tech and algorithmic, so it must be the wave of the future.

But don’t let the fancy trappings fool you: What’s really happening is a determined march to the days when money meant stuff you could jingle in your purse. In tropics and tundra alike, we are for some reason digging our way back to the 17th century.

This is just a lie. $1000 today is equal to the purchasing power of $353 dollar in 1980–which I would say is a hell of a lot of debasement. Furthermore, how is an inflation rate of +10% in 28 countries ‘rare’? What men like Paul fail to understand is that the government is not our savior, but a tyrant.

All of the economic woes of today could be end with the stroke of a pen from our government. The government could build huge public works programs, nationalize the banks, and take homes from the banks and give them to homeless.

But they don’t.

They don’t because there is no economic incentive for them to care about the poor, about the slow death of the economy for the middle class, or of even acting like they want to help us. The average American’s net worth has dropped 8 percent during the past seven years, while members of Congress got, on average, 15 percent richer. The only explanation for congress members having on average about 10 time the average wealth of americans, is that their corruption offers them special privileges, at the expense of everyone else.

This is why people are choosing commodity moneys over fiat money. We see the criminals that these people are, and the way that they are destroying the true wealth and industriousness of this nation. We want a money they cannot control, because they have proven time and time again that they cannot be trusted to control the wealth of a nation. Don’t let the rambling of a foolish man in a professors clothing fool you–the governments of the world seek to be good masters, but they seek to be your master.

In recent months the fall out from the GOX fiasco has really weathered bitcoin. From seeing its highest price of around $1126 and a low of $394, the market has weathered some amazing news, mostly due to the fails of the largest, now defunct bitcoin exchange MtGox. MT. GOX (frequently called Mount Gox, is really an abbreviation of Magic: The Gathering Online eXchange) closed its doors and officially announced bankruptcy, stating that they had been robbed of most of their bitcoins. But since then there have been some rumblings of foul play from the like of The Idiot, and some concerns with coins that have tainted links to Mtgox. What I suspect is that Mark cut a deal.

In recent months the fall out from the GOX fiasco has really weathered bitcoin. From seeing its highest price of around $1126 and a low of $394, the market has weathered some amazing news, mostly due to the fails of the largest, now defunct bitcoin exchange MtGox. MT. GOX (frequently called Mount Gox, is really an abbreviation of Magic: The Gathering Online eXchange) closed its doors and officially announced bankruptcy, stating that they had been robbed of most of their bitcoins. But since then there have been some rumblings of foul play from the like of The Idiot, and some concerns with coins that have tainted links to Mtgox. What I suspect is that Mark cut a deal.

In a recent New York Times Op-ed “

In a recent New York Times Op-ed “

Krugman opens his article with talking about the human rights violations that are occurs in gold mines, like the

Krugman opens his article with talking about the human rights violations that are occurs in gold mines, like the  As true as this theory is, it is not the way that the governments have used their power of seigniorage. Instead this power has been used to give free money to the wealthiest organizations in the world: banks.

As true as this theory is, it is not the way that the governments have used their power of seigniorage. Instead this power has been used to give free money to the wealthiest organizations in the world: banks. wealth of the nation because it wasn’t doing anything. This is why he thought that paper money was a good–though imperfect–method of engaging the value of the gold and silver. Smith states,

wealth of the nation because it wasn’t doing anything. This is why he thought that paper money was a good–though imperfect–method of engaging the value of the gold and silver. Smith states,

The most powerful weapon that we have is refusal. Our obedience within this system of State-sponsored capitalism, where we are made debt slaves for wanting a better education, getting sick, or having a home, is far from a fair system–it is criminal in everything but name. If we are to stop this kind of abuse we first must refuse to participate in this kind of abuse.

The most powerful weapon that we have is refusal. Our obedience within this system of State-sponsored capitalism, where we are made debt slaves for wanting a better education, getting sick, or having a home, is far from a fair system–it is criminal in everything but name. If we are to stop this kind of abuse we first must refuse to participate in this kind of abuse.

Bitcoin is a radical new technology that we do not fully understand the impact of quite just yet, and most likely, we will not for years to come. As this economy grows, evolves, and has more market participants, the itching question is, how will this affect the political situations of the world? At first glance bitcoin may not seem like much at all, but when you look at bitcoin through the lens that it is independent wealth controlled by no nation-state, there are some interesting questions that are called into play.

Bitcoin is a radical new technology that we do not fully understand the impact of quite just yet, and most likely, we will not for years to come. As this economy grows, evolves, and has more market participants, the itching question is, how will this affect the political situations of the world? At first glance bitcoin may not seem like much at all, but when you look at bitcoin through the lens that it is independent wealth controlled by no nation-state, there are some interesting questions that are called into play. “Bills of attainder, ex post facto laws, and laws impairing the obligations of contracts, are contrary to the first principles of the social compact, and to every principle of sound legislation. … The sober people of America are weary of the fluctuating policy which has directed the public councils. They have seen with regret and indignation that sudden changes and legislative interference, in cases affecting personal rights, become jobs in the hands of enterprising and influential speculators, and snares to the more-industrious and less-informed part of the community.” —James Madison

“Bills of attainder, ex post facto laws, and laws impairing the obligations of contracts, are contrary to the first principles of the social compact, and to every principle of sound legislation. … The sober people of America are weary of the fluctuating policy which has directed the public councils. They have seen with regret and indignation that sudden changes and legislative interference, in cases affecting personal rights, become jobs in the hands of enterprising and influential speculators, and snares to the more-industrious and less-informed part of the community.” —James Madison

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

I work at a bank and I am in charge of the operations side of handling international wires. Granted, I have no power in the decision making process of how things are done, which is really too bad because I just have to watch the bank I work at, and the customers that I am servicing throw away good money on a shitty service. Part of this is the bank’s fault, but I have to empathize a bit, because most of the decision is not within our hands, but is from new international wire regulations handed down by the federal government. Sadly, we act as an extension of the state, instead of seeing ourselves as a counter-balance against the state. This means that when approaching issues, we are more prone to “play it safe,” than to try something new and risk upsetting the masters of money: the government.

I work at a bank and I am in charge of the operations side of handling international wires. Granted, I have no power in the decision making process of how things are done, which is really too bad because I just have to watch the bank I work at, and the customers that I am servicing throw away good money on a shitty service. Part of this is the bank’s fault, but I have to empathize a bit, because most of the decision is not within our hands, but is from new international wire regulations handed down by the federal government. Sadly, we act as an extension of the state, instead of seeing ourselves as a counter-balance against the state. This means that when approaching issues, we are more prone to “play it safe,” than to try something new and risk upsetting the masters of money: the government.

The banking industry is not independent in any way, shape, or form from the government. It is an organization that exist because the state allows it to in exchange for complying to the heavily regulations that are demand of banks. In fact,

The banking industry is not independent in any way, shape, or form from the government. It is an organization that exist because the state allows it to in exchange for complying to the heavily regulations that are demand of banks. In fact,

The world is a screwed up place and things for many do not seem to be getting better. The U.S. Federal government is dysfunctional beyond repair, with

The world is a screwed up place and things for many do not seem to be getting better. The U.S. Federal government is dysfunctional beyond repair, with  Despite all of these horrors going on in the world,

Despite all of these horrors going on in the world,