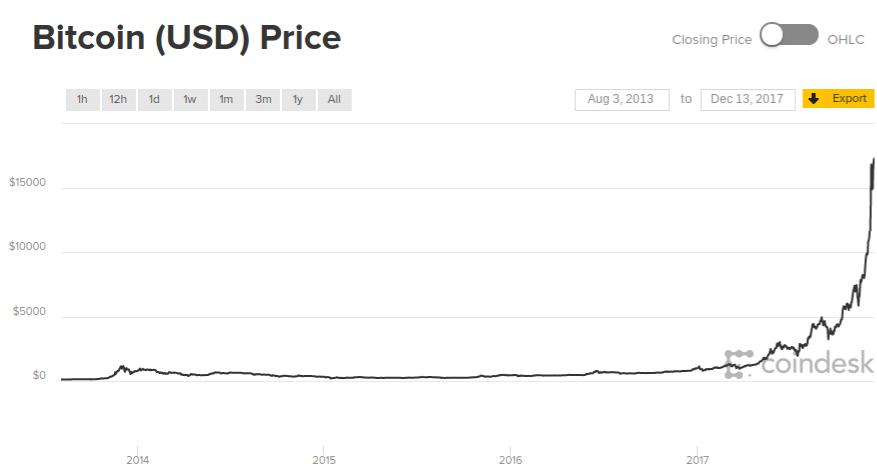

When I first started writing this blog, the price of a single bitcoin was around $230 or so. Today the price of a single bitcoin is beyond $17,000 along with a whole slew of new financial assets that have been created by no governments or bankers; but by cryptography, computers, and coders alone.

This new kind of money serves not the interests of the banking and corporate elites, or the corrupt government ministers who kowtow to them; but the people who control them alone.

We have seen Bitcoin become the most valuable financial asset in human history despite all of the harping of bankers, economist, and purported ‘experts’ of finance, economics, and money. They have declared bitcoin are a scourge, that it is ‘rat poison’ and is something to be detested. They say that bitcoin is a grievous wound against all of society, and it must be destroyed. Again and again we hear from them that bitcoin is a bubble, that it has no social value, and that it is going to ‘crash’–and yet we find that the honey badger of money continues its slog upward and to the right despite all of their raging cries.

This is by no mistake, as Bitcoin is fundamentally better at storing value than any fiat currencies in existence today. This is because of bitcoin’s fixed and known monetary supply and monetary inflation rates. More importantly however is the social consciousness and consensus that allows for bitcoin to exist and never be destroyed. People can now control their personal wealth with nothing more than the power of cryptography. Bitcoin is rewriting the entire way that money is understood and used, which will become a political conquest within the coming decades.

Saving in fiat money is for chumps

“Why would anyone outside of a lunatic asylum want to hold money? What an insane use to put it! For it is a recognized characteristic of money as a store of wealth that it is barren; whereas practically every other form of storing wealth yields some interest or profit.”

–John Maynard Keynes

Today, each and every form of fiat money is nothing more than a legal tender that holds value simply because governments command it. However, if we look over the course of history; again, and again, we see states fail, governments collapse, and their money always inflates to nothing. This is not by mistake, but by design. Just look at what has happened in Venezuela over the last few years.

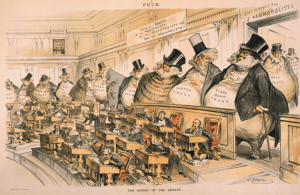

What those in contemporary finance and government fail to see is that bitcoin radically departs from state-sponsored financial systems and the tyranny that they enable. For the better part of modern human history we have simply had to deal with the fact that government officials could show up at our places of business or our homes, rob us at gun point and call it legal. That governments everywhere could simply fictionalize up mountains of money and give it to their corrupt banking and corporate friends, and tell us it was for our own good.

Again and again, we see the powers-that-be prod us down the road to serfdom, and tell us it is the yellow brick road to the Emerald City. We have seen what happens to those who follow that path, and the poverty it creates for all of us.

The revolution that we have all been waiting for is finally here, and it is the radical divorce of state and money from each other. Governments were never entitled to steal the wealth of the world for themselves and for their barbaric and unholy purposes. We finally have a way to resist their tyranny and fight back with economic means alone. Just as we once saw the radical divorce of church and state fundamentally change society for the better, we will once again witness such a radical epochal change–but this time it will be from the separation of money from the state.

Those of us who hodl bitcoin know and understand that bitcoin has nothing to do with money. The true purpose of Bitcoin is to create a new form of economic power that will be the harbinger of a new society from which freedom and liberty are more than meager slogans. Bitcoin will empower a society where all economic power is outside and beyond the control of the state; and the monstrous banking and financial sectors will be vanquished from this earth once and for all. It is from this base of power that we are creating that a whole new society within the framework of the web that will allow for us to free ourselves from debt bondage, and corporate slavery forever.

Bitcoin will become the most value asset in history not only because it is a better form of money, but because of the astounding economic, social, and political power it creates. Through tearing out the economic base of the corrupt systems of fiat money; we can create a new and more egalitarian society using the power of the Bitcoin and cryptography. The banners we will raise in this new society will have the following inscribed upon them for all to see and choose to follow if they wish:

Bitcoin turned eight years old this week and the price is back above $1000 per coin. For those of us that have valiantly and steadfastly been working on the finance system of the future for the last few years, we are all reaping the rewards of our efforts today.

Bitcoin turned eight years old this week and the price is back above $1000 per coin. For those of us that have valiantly and steadfastly been working on the finance system of the future for the last few years, we are all reaping the rewards of our efforts today. Bitcoin is the trojan horse of the fiat monetary system and will ultimately end the state’s control of money. However this process will also compromise bitcoin’s core principals and cause for the corruption of bitcoin’s pseudonymous traits. Over the next decade as the cryptoeconomy expands its reach to become truly global, the financial system will quake as its foundation shifts from state fiat money, to decentralized digital currencies. While we should celebrate the rise of digital currencies, the full collapse of governments and global financial system is unlikely.

Bitcoin is the trojan horse of the fiat monetary system and will ultimately end the state’s control of money. However this process will also compromise bitcoin’s core principals and cause for the corruption of bitcoin’s pseudonymous traits. Over the next decade as the cryptoeconomy expands its reach to become truly global, the financial system will quake as its foundation shifts from state fiat money, to decentralized digital currencies. While we should celebrate the rise of digital currencies, the full collapse of governments and global financial system is unlikely.

This new global monetary system where bitcoin will act as the rails of the financial system is magnitudes more efficient than all current fiat systems. This will create a

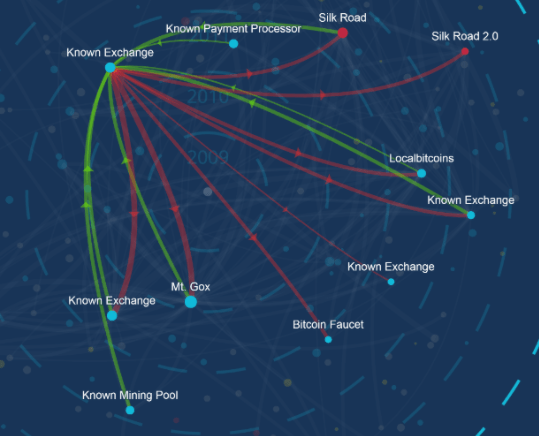

This new global monetary system where bitcoin will act as the rails of the financial system is magnitudes more efficient than all current fiat systems. This will create a  Bitcoin has some flaws in regards to its privacy that should scare off neer-do-wellers and privacy advocates alike. However, these same aspects are what makes bitcoin very, very appealing to the financial world, and is the reason they will start using bitcoin as their base currency under the mantra of ‘blockchain’. The transparent nature of the blockchain offers the possibility of a totally regulated and systematized world of digital currencies that is a statist wet-dream. However, through implementing such a system, states will also lose control of their choke hold on the economy, and will eventually find it slipping through their grip entirely. The fundamental truth is that Bitcoin and other cryptocurrencies are better money than ANY form of money that we have ever seen! This is by virtue of that cryptocurrencies are not state-controlled, and cannot be state-controlled. It is plain and simple economics at the end of the day which is going to cause for bitcoin and other digital currencies to win out over fiat money.

Bitcoin has some flaws in regards to its privacy that should scare off neer-do-wellers and privacy advocates alike. However, these same aspects are what makes bitcoin very, very appealing to the financial world, and is the reason they will start using bitcoin as their base currency under the mantra of ‘blockchain’. The transparent nature of the blockchain offers the possibility of a totally regulated and systematized world of digital currencies that is a statist wet-dream. However, through implementing such a system, states will also lose control of their choke hold on the economy, and will eventually find it slipping through their grip entirely. The fundamental truth is that Bitcoin and other cryptocurrencies are better money than ANY form of money that we have ever seen! This is by virtue of that cryptocurrencies are not state-controlled, and cannot be state-controlled. It is plain and simple economics at the end of the day which is going to cause for bitcoin and other digital currencies to win out over fiat money.

Bitcoin and digital currencies will always be a cheaper monetary systems to maintain and utilize than a fiat money, partially when we consider the cost of scaling and security over the long-term, and on a global scale. Due to the unique construction of digital currencies from a security stand point, digital currencies create nearly perfectly secure money systems at rest. Out of the box, through cryptographic functionalities built directly into digital currency protocols; they are magnitudes more secure, efficient, and scalable than fiat money. Fiat money must be defended from counter-fitting, banking fraud, note destruction, and physical theft. Fiat money will always be more expensive to service, use, and maintain as a whole monetary system than any kind of digital currency system because of those weaknesses and flaws. Digital currencies have greater security and scalability than their fiat counterparts as well.

Bitcoin and digital currencies will always be a cheaper monetary systems to maintain and utilize than a fiat money, partially when we consider the cost of scaling and security over the long-term, and on a global scale. Due to the unique construction of digital currencies from a security stand point, digital currencies create nearly perfectly secure money systems at rest. Out of the box, through cryptographic functionalities built directly into digital currency protocols; they are magnitudes more secure, efficient, and scalable than fiat money. Fiat money must be defended from counter-fitting, banking fraud, note destruction, and physical theft. Fiat money will always be more expensive to service, use, and maintain as a whole monetary system than any kind of digital currency system because of those weaknesses and flaws. Digital currencies have greater security and scalability than their fiat counterparts as well. Payment and storage of value systems are huge social networks of economic acceptance. This is why new, crisp $100 bills are accepted almost anywhere in the world due to the economic hegemony of the U.S. dollar. However, there is nothing in the dollar bills themselves that have true value; just that the next person who gets that bill will know that it is worth $100–a relatively stable value against many local currencies like the Venusalian Bolivar, or the Argentinian Peso, which have both experienced bouts of hyperinflation.

Payment and storage of value systems are huge social networks of economic acceptance. This is why new, crisp $100 bills are accepted almost anywhere in the world due to the economic hegemony of the U.S. dollar. However, there is nothing in the dollar bills themselves that have true value; just that the next person who gets that bill will know that it is worth $100–a relatively stable value against many local currencies like the Venusalian Bolivar, or the Argentinian Peso, which have both experienced bouts of hyperinflation. Due to a condition that is similar to

Due to a condition that is similar to

“Each country has its own ruling class. In capitalist countries, the rulers own the means of production and employ workers. The capitalist class is also called the bourgeoisie. Means of production are what it takes to produce goods. Raw materials, satellite networks, machinery, ships and factories are examples. Workers own nothing but their ability to sell their labor for a wage.” -Karl Marx

“Each country has its own ruling class. In capitalist countries, the rulers own the means of production and employ workers. The capitalist class is also called the bourgeoisie. Means of production are what it takes to produce goods. Raw materials, satellite networks, machinery, ships and factories are examples. Workers own nothing but their ability to sell their labor for a wage.” -Karl Marx Money is the central component of a capitalist system. This once was gold, sliver, and other commodity-monies, but as the state grew in power throughout the centuries, it came to regard the freedom of money as ‘dangerous’ and seized all forms of commodity-monies. Ironically,

Money is the central component of a capitalist system. This once was gold, sliver, and other commodity-monies, but as the state grew in power throughout the centuries, it came to regard the freedom of money as ‘dangerous’ and seized all forms of commodity-monies. Ironically,

Usually a public offering from a company is going to take millions of dollars, lots of legal fees, and huge amounts of regulatory oversight. The massive inefficiencies and regulatory burdens of this process has locked out most people from being able to be involved in this process, and unable to reap the massive profits that can come from high-risk investing like this. Now with the ability to raise tens of millions of dollars using cryptocurrencies, almost anyone can create a public offering for just fractions of what it once cost. The most common way of doing this with crypto at this time is through an initial coin offering (ICO).

Usually a public offering from a company is going to take millions of dollars, lots of legal fees, and huge amounts of regulatory oversight. The massive inefficiencies and regulatory burdens of this process has locked out most people from being able to be involved in this process, and unable to reap the massive profits that can come from high-risk investing like this. Now with the ability to raise tens of millions of dollars using cryptocurrencies, almost anyone can create a public offering for just fractions of what it once cost. The most common way of doing this with crypto at this time is through an initial coin offering (ICO). Monero in many ways is what bitcoin originally wanted to be. Using a new kind of cryptographic protocol that is different from bitcoin, Monero provides strong anonymity that ensures that users financial information, along with their personal identity is much harder to track then it is with bitcoin. For this reason, several darknet markets have recently started supporting Monero, and Monero looks like it is trying to create its own niche within the cryptoeconomy centered around true anonymity and privacy.

Monero in many ways is what bitcoin originally wanted to be. Using a new kind of cryptographic protocol that is different from bitcoin, Monero provides strong anonymity that ensures that users financial information, along with their personal identity is much harder to track then it is with bitcoin. For this reason, several darknet markets have recently started supporting Monero, and Monero looks like it is trying to create its own niche within the cryptoeconomy centered around true anonymity and privacy. Augur is a Dapp, meaning that it was built on top of etheruem as a decentralized app. Augur is the first of a few different prediction market apps that seek to create a prediction platform by letting users bet on pretty much anything. You can check out more information about it here:

Augur is a Dapp, meaning that it was built on top of etheruem as a decentralized app. Augur is the first of a few different prediction market apps that seek to create a prediction platform by letting users bet on pretty much anything. You can check out more information about it here:  There are a few different projects similar to FileCoin such as Storj and Madesafe, which are all seeking to create a decentralized storage and hosting solution for the web. These are the kinds of huge, infrastructure changing, decentralizing projects which I think can radically change the internet, and in turn society itself. While FileCoin has not had an ICO yet, both Madesafe and Storj have, and they also have small limited application of the project released. These are the sort of radical project that are creating the new cryptoeconomy.

There are a few different projects similar to FileCoin such as Storj and Madesafe, which are all seeking to create a decentralized storage and hosting solution for the web. These are the kinds of huge, infrastructure changing, decentralizing projects which I think can radically change the internet, and in turn society itself. While FileCoin has not had an ICO yet, both Madesafe and Storj have, and they also have small limited application of the project released. These are the sort of radical project that are creating the new cryptoeconomy.

“If revolutions and insurrections correspond to constituent power, that is, a violence that establishes and constitutes the new law, in order to think a destituent power we have to imagine completely other strategies, whose definition is the task of the coming politics. A power that was only just overthrown by violence will rise again in another form, in the incessant, inevitable dialectic between constituent power and constituted power, violence which makes the law and violence that preserves it.” -Giorgio Agamben

“If revolutions and insurrections correspond to constituent power, that is, a violence that establishes and constitutes the new law, in order to think a destituent power we have to imagine completely other strategies, whose definition is the task of the coming politics. A power that was only just overthrown by violence will rise again in another form, in the incessant, inevitable dialectic between constituent power and constituted power, violence which makes the law and violence that preserves it.” -Giorgio Agamben