Over the last several years I have worked on this body of articles in an attempt to create a cohesive Theory of Bitcoin. Here is my abstract:

The Internet is a sovereign territory that exist outside and above the control of all state governments. Due to the international nature, and economic dependence that all states have on the internet; the internet has now become a spectre that is beyond any of their control. This combine with the imperious nature of bitcoin forms a new kind of money and power that can render the state useless. This power can supplant state institutions, and allow for all people of the world to economically and politically unite in 21st century, but only if we struggle to make it so. Using the internet and bitcoin we can create an international digital sydicate that will allow for the free economic and information exchange of all people around the globe as a single political body.

—

I have divided my writings into three (I, II, III) distinct sections. Part one explores the legal history of money; part two covers the economic functions of bitcoin; and part three covers the radical political, social, and economic ramifications of bitcoin.

Part One

This rather long section is of necessity to understand what exactly money is and how it functions from a legal and historical standpoint. There is a long and complicated legal and economic history of money and we must have some understanding of it in order to see how money is a distinct and separate object from value. We must understand that legal power over a long history has literally striped the intrinsic value from money, and replaced it with a false idol of fiat money. This is a form of theft that is only possible through legal means. This has allowed for all States to steal from their citizenry with great sophistication and guile through their alliance with the bankers. It has been over the course of several generations that money has ever-so-slowly lost its power as an intrinsic vehicle for wealth, and been enshrined in the legalist framework of state-capitalism. It is through the State’s monopolization of the mode of exchange–money itself–which has allowed for the State to divorced fiat money from intrinsic value. This in turn has created the great number of economic issues we face today.

To divorce intrinsic value from money itself is an incredible feat for the state; however, it is not without its problems. The state can only monopolize money through force and ideology, not majesty or science. States will always be unsuccessful with the monopolization of money, and history can testify to that.

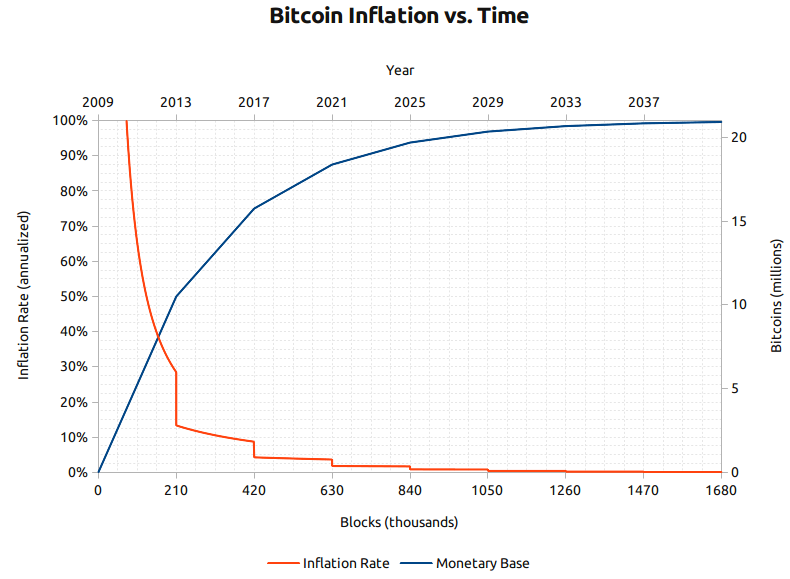

This is where understanding the mechanics of bitcoin becomes extremely important. Because of bitcoin’s known, fixed monetary supply, infinite divisibility, and imperious security through cryptography; bitcoin becomes something much more than just money, wealth, or value. Bitcoin creates a totally independent, stateless system of economic and information exchange that is pseudonymous over the internet. This is extraordinarily revolutionary, as it creates the basis for a new economic system built on top of cryptography outside of the mortality and corruption of law. This will usher in an epochal change that happens only a few times each millennial!

Once we understand the mechanics of bitcoin we can see that it is truly digital gold. And just like gold, it will be impossible to eradicate from the world. However, there is one feature that dramatically separates bitcoin from that of other commodity monies: its non-physical nature.

The power of the non-physical nature of bitcoin eludes to what I have taken to calling The Digital Sovereign. This is the real power of the internet to affect and change society from without, as a sovereign force. It is with bitcoin that the internet has an economic mode for itself. This economic mode is what will start to radicalize the internet on a whole. When the internet sees the true power that lies within it to change the world, how it can do it with its own money, there will be nothing to stop it.

Part Two

Section two mainly covers the economic functions of bitcoin. First we will explain the mathematical and cryptographic features that make bitcoin provably better money than any money that exist today. We will go into detailed analysis of the features of good moneys, and how bitcoin exudes and embodies all of those ideals in the most scientific manner. This will allow for us to go into a detailed analysis of current system of fiat monetary exchange as a commodity itself. This commodity is the network that is money. Through treating fiat money in this way, we can directly contrast and analysis it against bitcoin.

It is from this lens that we can drive a wedge between the value of money itself as a network, from the value of the legal force embedded within that money. This is explained in the first section in regards to bonitas intresica, and valors imporium. Once we can see all money as being only a network of exchange, than we can see how that network operates both inside and outside of the hands of governments, and their limited economic control.

When we take various economic theories such as Grehmsham’s Law, Course’s Transaction Theory, and the works of Keynes, Gesell, Hayak, and combine them with the praxis of crypto-anarchism, we are given a radical new understanding of bitcoin. It is once we understand how bitcoin functions economically, and why it is superior to other forms of money, that bitcoin shows itself to be the technological tour-de-force that it is.

Finally, taking Schumpeter’s theory of creative destruction, we can see laid out before us the radical and revolutionary technological power that bitcoin will use to change the world. This is not an opinion, but a fact of economic function. This is given to us by Hayak, who offers us a glimpse into the future with liberated money. In his magnum opus “The Denationalization of Money,” he describes how a world of competitive, non-state currencies would work, and how it can answer the economic and political crises of today.

With the application of understanding bitcoin as a commodity money, we can apply classic banking practices within bitcoin to create a new form of money through transparent fractional banking. This will be the model that will allow bitcoin to become the rails of the financial system, and for bitcoin to build its own debt-based units. This will spell the doom of the contemporary banking and monetary system.

This new form of money is the bridge to the future, and is the core nexus of the ideological development that will be the next epoch of humanity: The Digital Sovereign. It will be the answer to how humans are going to solve all of the monumental and heart-wrenching issues that plague our world today. With the historical and economic ramifications of bitcoin explained from the first two sections, we can now go into the third and most important of the three sections: The political power of bitcoin.

Part Three

Bitcoin is not about money at all… it is about our core values of human-beings and what it means to be free people. Freedom is a condition and identity that is acknowledge through condition alone, and today we are not free, but we can be. Through organizing around the use of bitcoin for ALL of our economic exchange and holding of bitcoin as a form of economic resistance, we can exert true political pressure on a corrupt system through economic means. If just 1% of the world’s population would be militant enough to use bitcoin in this way, as a revolutionary tool to help people organize against the machine, it would be but a week before the system started to seize, and less than a month before it were in cataclysmic turmoil.

This is the power of revolutionary syndicalism on a transglobal scale; we can use the internet and bitcoin to organize ourselves and achieve revolutionary ends. We can organize politically, independent of one another, while having economic solitary together against our respective governments. Using bitcoin as an economic weapon against the corrupt state-capitalist machine to which we all belong, we can realistically create dramatic change in our world. Pulling from the historic traditions of anarchism, we can ultimately organize around the theory of the general strike. This will cause for a complete collapse of the State-capitalism as we know it so we may transition to a new way forward.

This is only possible if we proactively start building towards a better tomorrow now! We must do this through the formation of a revolutionary political union, and advocate from this seemingly radical stance. Through the use of the internet as an ideological tool, we will create a new class consciousness. This class consciousness will fully contain and represent the international proletariate through the ability of all people everywhere to use, interact and organize with the internet itself; and to use bitcoin as the economic vehicle to bring about change.

—

Next Section: Sovereign Violence and Legitimacy of Law

For this post I am going to pretend that bitcoins are real coins that are minted from a new metal called Satoshium. This metal is ugly, has few uses, and cannot be physically touched, as it is invisible–overall it is pretty useless. However this new metal is very, very divisible, malleable and it can be transported over any digital communication channel. All Satoshium that will ever comes into existence is created through the coinbase reward that ‘mints’ bitcoin units, which happens during the process of ‘bitcoin mining’.

For this post I am going to pretend that bitcoins are real coins that are minted from a new metal called Satoshium. This metal is ugly, has few uses, and cannot be physically touched, as it is invisible–overall it is pretty useless. However this new metal is very, very divisible, malleable and it can be transported over any digital communication channel. All Satoshium that will ever comes into existence is created through the coinbase reward that ‘mints’ bitcoin units, which happens during the process of ‘bitcoin mining’.

Satoshium is really the coinbase reward, which is the raw material that bitcoins are minted from (fun fact, the only way you can truly destroy a bitcoin is through not claiming the full coinbase reward). In the same manner that gold is just a hunk of metal before it is minted into a coin; so is satoshium is to bitcoin. When someone is rewarded for satoshium mining, those satoshium units are grouped into chunks of 100 million units and ‘minted’ single bitcoin. This is the coinbase reward process. This ‘mints’ satoshium units into bitcoins based upon what the block reward is at that time, and pays that reward of new coins out to a new bitcoin address. This is the ‘minting’ process and how the bitcoin network creates new bitcoins.

Satoshium is really the coinbase reward, which is the raw material that bitcoins are minted from (fun fact, the only way you can truly destroy a bitcoin is through not claiming the full coinbase reward). In the same manner that gold is just a hunk of metal before it is minted into a coin; so is satoshium is to bitcoin. When someone is rewarded for satoshium mining, those satoshium units are grouped into chunks of 100 million units and ‘minted’ single bitcoin. This is the coinbase reward process. This ‘mints’ satoshium units into bitcoins based upon what the block reward is at that time, and pays that reward of new coins out to a new bitcoin address. This is the ‘minting’ process and how the bitcoin network creates new bitcoins.

Bitcoin is a commodity money because the cryptography that bitcoin is built on top of. This has created the contract that limits the supply of bitcoin units and protects the bitcoin payment network. It is cryptography that creates the immutable and fungibility of bitcoin units and the imperium of the bitcoin network. This immutability creates a use-value for bitcoin, which also creates its exchange value. Furthermore, the ‘satoshium’ units of bitcoin can be broken down and used for all sort of other various contractual functions. By understanding bitcoin as a commodity money, we can see the true value that bitcoin has is outside of the legal constructs of the state.

Bitcoin is a commodity money because the cryptography that bitcoin is built on top of. This has created the contract that limits the supply of bitcoin units and protects the bitcoin payment network. It is cryptography that creates the immutable and fungibility of bitcoin units and the imperium of the bitcoin network. This immutability creates a use-value for bitcoin, which also creates its exchange value. Furthermore, the ‘satoshium’ units of bitcoin can be broken down and used for all sort of other various contractual functions. By understanding bitcoin as a commodity money, we can see the true value that bitcoin has is outside of the legal constructs of the state. To understand Bitcoin, we need to also understand the history of money. This is a long and complex topic that has changed dramatically over the last 400 years, and has a total history of more than 3000 years. In order to understand both money, and bitcoin, we need to understand that there are two distinct functions that money has, that are independent of each other, but both influences money’s value: the payment function of money, and its storage of value function.

To understand Bitcoin, we need to also understand the history of money. This is a long and complex topic that has changed dramatically over the last 400 years, and has a total history of more than 3000 years. In order to understand both money, and bitcoin, we need to understand that there are two distinct functions that money has, that are independent of each other, but both influences money’s value: the payment function of money, and its storage of value function. near the end of WWII, the allies came together in secret meeting in Bretton Woods to negotiate how the new global economy would be built. Keynes wanted an

near the end of WWII, the allies came together in secret meeting in Bretton Woods to negotiate how the new global economy would be built. Keynes wanted an

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”