Bitcoin and other digital currencies are new kinds of money and exchange networks that are superior in nearly every way to state-controlled fiat money. Due to the fact that all monies are directly competing with one another as economic units, money create a zero-sum game of competitive economics against one another. When we see the kind of capital efficiency that bitcoin and other digital currencies exude from their near-zero transaction cost, scalablity, security, and most importantly not being controlled by any government, we can see there is no way that fiat money can ever win over digital currencies in terms of their economic efficiency.

Capital Efficiency

Bitcoin and digital currencies will always be a cheaper monetary systems to maintain and utilize than a fiat money, partially when we consider the cost of scaling and security over the long-term, and on a global scale. Due to the unique construction of digital currencies from a security stand point, digital currencies create nearly perfectly secure money systems at rest. Out of the box, through cryptographic functionalities built directly into digital currency protocols; they are magnitudes more secure, efficient, and scalable than fiat money. Fiat money must be defended from counter-fitting, banking fraud, note destruction, and physical theft. Fiat money will always be more expensive to service, use, and maintain as a whole monetary system than any kind of digital currency system because of those weaknesses and flaws. Digital currencies have greater security and scalability than their fiat counterparts as well.

Bitcoin and digital currencies will always be a cheaper monetary systems to maintain and utilize than a fiat money, partially when we consider the cost of scaling and security over the long-term, and on a global scale. Due to the unique construction of digital currencies from a security stand point, digital currencies create nearly perfectly secure money systems at rest. Out of the box, through cryptographic functionalities built directly into digital currency protocols; they are magnitudes more secure, efficient, and scalable than fiat money. Fiat money must be defended from counter-fitting, banking fraud, note destruction, and physical theft. Fiat money will always be more expensive to service, use, and maintain as a whole monetary system than any kind of digital currency system because of those weaknesses and flaws. Digital currencies have greater security and scalability than their fiat counterparts as well.

Scalability and Security

Payment and storage of value systems are huge social networks of economic acceptance. This is why new, crisp $100 bills are accepted almost anywhere in the world due to the economic hegemony of the U.S. dollar. However, there is nothing in the dollar bills themselves that have true value; just that the next person who gets that bill will know that it is worth $100–a relatively stable value against many local currencies like the Venusalian Bolivar, or the Argentinian Peso, which have both experienced bouts of hyperinflation.

Payment and storage of value systems are huge social networks of economic acceptance. This is why new, crisp $100 bills are accepted almost anywhere in the world due to the economic hegemony of the U.S. dollar. However, there is nothing in the dollar bills themselves that have true value; just that the next person who gets that bill will know that it is worth $100–a relatively stable value against many local currencies like the Venusalian Bolivar, or the Argentinian Peso, which have both experienced bouts of hyperinflation.

Despite the wide acceptance of the U.S. dollar, it still has the fundamental problem of transportation, security, and counterfeiting that all fiat money has–a huge expense that cost the US economy about $250 billion dollars a year. That expense is imbued into all U.S dollar transactions due to the inherent nature of fiat monetary system. As the size and scale of the U.S. dollar usage increases, so does the degree of fraud, and counterfeiting that occurs. This amount of counterfeiting and fraud is proportional to the total supply of hard money within a fiat money system, and is a fundamental flaw of any kind of state-issued fiat money.

It is this scalability flaw within all fiat money system that digital currencies exploits to be superior money. This allows for digital currencies to be magnitudes more efficient at being a mode of exchange, and a storage of wealth than any money there is today. Digital currencies have the capacity to scale so much more securely and efficiently then fiat money that they will prove themselves to be more efficient then all fiat money.

Capital Competition

Due to a condition that is similar to undercover interest rate parity, digital currencies will always offer an opportunity for profit over fiat. This is not due to an actual higher interest rate of digital currencies, but due to an increase in the demand for digital currencies over the total available, fixed, known supply. This causes for value appreciation of digital currencies as demand outstrips the limited supply. What gives digital currencies their distinct advantage over fiat is that the networks is that the money supply cannot be inflated at will. This creates an unmailable supply which is nearly impossible to change, unlike all fiat monies.

Due to a condition that is similar to undercover interest rate parity, digital currencies will always offer an opportunity for profit over fiat. This is not due to an actual higher interest rate of digital currencies, but due to an increase in the demand for digital currencies over the total available, fixed, known supply. This causes for value appreciation of digital currencies as demand outstrips the limited supply. What gives digital currencies their distinct advantage over fiat is that the networks is that the money supply cannot be inflated at will. This creates an unmailable supply which is nearly impossible to change, unlike all fiat monies.

When comparing whole monetary systems, bitcoin and other digital currencies will always out preform fiat currencies because of how both currencies create their structural value. Fiat money will always be bonded to a state legal system that finds its value in the force of law, not the nature of value. Digital currencies value because the nature of markets and the protection offered by cryptography–people desire cryptocurrencies because of the traits of good money that they exude.

Digital currencies will never have the same legal and economic burdens to service as fiat money does. This means digital currencies will always have a lower systemic transaction cost than any fiat system, which makes them more economically efficient. Sovereign digital capital will always out preform state fiat capital.

Digital currencies are simply better forms of money than state-controlled money.

Conclusion

Funny that he sees that, yet he seems to be unaware that bitcoin and other DCs are going to destroy his wealth.

Due to the zero-sum nature of how currency competition economics function, bitcoin and other digital currencies present an existential threat to all forms of state fiat money. Bitcoin and other digital currencies have a lower transaction cost and greater security and scalability than fiat money. Over the next decade we are going to see one of the greatest transference of wealth the world has ever seen, and it will be from the failure of fiat money the coming economic hegemony of digital currencies.

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

“The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U. S. Steel illustrate the same process of industrial mutation-if I may use that biological term-that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.”

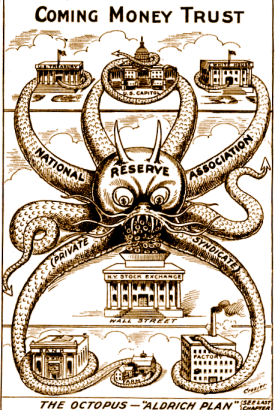

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

Once upon a time, storing your money within a bank to offer you the security of knowing that your money was safe and secure. In addition to helping one secure their money, banks also found the opportunity to make the use of money sitting in their vaults through allowing easier access to the funds through services like checks, debit cards, and credit cards. As these services evolved, the banking system started taking more and more ‘convenience fees’ for access your very own money! But what is one to do when all banks are part of the greater monopoly that makes up the various national money systems? Until now, nothing–but now because bitcoin challenges this monopoly, and it is much more efficient than this monopoly, it is going to break this monopoly. The fiat money system just cannot compete–it’s too slow, too prone to fraud, and there are too many fees. This is in addition to inflation that has proven itself time and time again to destroy the savings of all the general public. When one see all of the benefits that bitcoin offers and understands how it works, there simply is no good reason to keep using fiat–it’s just shitty money.

The world is a screwed up place and things for many do not seem to be getting better. The U.S. Federal government is dysfunctional beyond repair, with

The world is a screwed up place and things for many do not seem to be getting better. The U.S. Federal government is dysfunctional beyond repair, with  Despite all of these horrors going on in the world,

Despite all of these horrors going on in the world, What Creates Transaction Cost?

What Creates Transaction Cost? The Law and what it offers

The Law and what it offers Those who are closes to the centers of power are the ones that will benefit the most from the law, or the corruption of the laws. This is why

Those who are closes to the centers of power are the ones that will benefit the most from the law, or the corruption of the laws. This is why