Bitcoin is the trojan horse of the fiat monetary system and will ultimately end the state’s control of money. However this process will also compromise bitcoin’s core principals and cause for the corruption of bitcoin’s pseudonymous traits. Over the next decade as the cryptoeconomy expands its reach to become truly global, the financial system will quake as its foundation shifts from state fiat money, to decentralized digital currencies. While we should celebrate the rise of digital currencies, the full collapse of governments and global financial system is unlikely.

Bitcoin is the trojan horse of the fiat monetary system and will ultimately end the state’s control of money. However this process will also compromise bitcoin’s core principals and cause for the corruption of bitcoin’s pseudonymous traits. Over the next decade as the cryptoeconomy expands its reach to become truly global, the financial system will quake as its foundation shifts from state fiat money, to decentralized digital currencies. While we should celebrate the rise of digital currencies, the full collapse of governments and global financial system is unlikely.

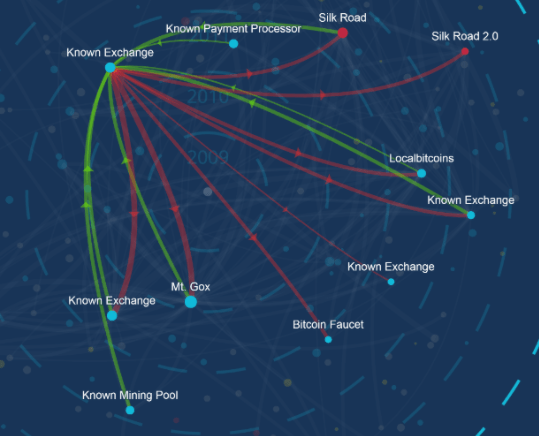

What we will see instead will be the horrifying metamorphosis of bitcoin into a panoptic nightmare. Bitcoin will be used by governments, bankers, and regulators to track our every purchase, and monitor all financial activity. Tainting tools will become so powerful that pretty much any bitcoin transaction will be possible to de-anonymize.

The crisis of fiat money will change not only finance and banking for the better, but the nature of governance as we know it. Bitcoin is going to be a trojan horse to the fiat banking system, and will destroy all government monopolies on this issuance of money. While bitcoin will be able to act as a check on the economic power of governments, in doing so it is also going to expose bitcoin to rigorous state regulations, and ultimately the full capturing of bitcoin as a whole system. Bitcoin may end the state’s control of money, but it may also open the path to the state’s ability to watch all financial transactions.

Inverting Bitcoin

Blythe Masters

This video at the Bank of England with Blythe Masters she speaks about what she believes to be in store for the future of bitcoin. She openly admit that the state supports her project, and that, “There will be no currency that gets around government controls.” Later the host of the program states, “There is no innovation that governments cannot seize for their own advantage…” This is followed by a discussion of the panopticon effect that bitcoin can have through tainting bitcoins and tracking their movements. All of this seems to be eluding to the capturing of bitcoin–banks and governments are working together to ‘inverting’ the blockchain to monitor all transactions.

Capturing Bitcoin

To capture bitcoin, all that governments need to do is auction off the bitcoin payment system to be regulated under the threat of force. This is already happening and companies like Coinalytics and Elliptic and providing the tools to taint and track bitcoins coming from anywhere. Effectively, this make every bitcoin highly traceable, which in turn can allow the banking system to merge with bitcoin to create a financial panopticon.

This new global monetary system where bitcoin will act as the rails of the financial system is magnitudes more efficient than all current fiat systems. This will create a lower general transaction cost when compared to any fiat money today, and will be the foothold that digital currencies will take to win out economically over fiat money in the long run. This is the inversion of bitcoin and will be how bitcoin will finally ‘die’ because of state compromise.

This new global monetary system where bitcoin will act as the rails of the financial system is magnitudes more efficient than all current fiat systems. This will create a lower general transaction cost when compared to any fiat money today, and will be the foothold that digital currencies will take to win out economically over fiat money in the long run. This is the inversion of bitcoin and will be how bitcoin will finally ‘die’ because of state compromise.

However, this is only the death of bitcoin’s body, not its soul.

Death by state and bank compromise will create the conditions for bitcoin’s core mission to be achieved through it becoming a trojan horse within their own system. This will cause for the destruction of fiat money, and will reassert the power of the purse back into the hands of the people.

There is no way that banks and financial service companies will be able to use ‘the blockchain’ (i.e. bitcoin) without also causing two other actions to happen simultaneously:

- The legitimization of bitcoin and other digital currencies as a global money.

- Exposing the legacy financial system to speculative attacks from the cryptocurrency economy, ultimately leading to a devaluation of fiat money against bitcoin and other cryptocurrencies as fiat money is displaced.

Capturing the State

If bitcoin becomes a global reserve currency, as the central bank of Barbados believes it could be, then bitcoin is forging a path towards capturing the state through the very means by which it has captured all of us: through economic means.

Bitcoin has some flaws in regards to its privacy that should scare off neer-do-wellers and privacy advocates alike. However, these same aspects are what makes bitcoin very, very appealing to the financial world, and is the reason they will start using bitcoin as their base currency under the mantra of ‘blockchain’. The transparent nature of the blockchain offers the possibility of a totally regulated and systematized world of digital currencies that is a statist wet-dream. However, through implementing such a system, states will also lose control of their choke hold on the economy, and will eventually find it slipping through their grip entirely. The fundamental truth is that Bitcoin and other cryptocurrencies are better money than ANY form of money that we have ever seen! This is by virtue of that cryptocurrencies are not state-controlled, and cannot be state-controlled. It is plain and simple economics at the end of the day which is going to cause for bitcoin and other digital currencies to win out over fiat money.

Bitcoin has some flaws in regards to its privacy that should scare off neer-do-wellers and privacy advocates alike. However, these same aspects are what makes bitcoin very, very appealing to the financial world, and is the reason they will start using bitcoin as their base currency under the mantra of ‘blockchain’. The transparent nature of the blockchain offers the possibility of a totally regulated and systematized world of digital currencies that is a statist wet-dream. However, through implementing such a system, states will also lose control of their choke hold on the economy, and will eventually find it slipping through their grip entirely. The fundamental truth is that Bitcoin and other cryptocurrencies are better money than ANY form of money that we have ever seen! This is by virtue of that cryptocurrencies are not state-controlled, and cannot be state-controlled. It is plain and simple economics at the end of the day which is going to cause for bitcoin and other digital currencies to win out over fiat money.

Bitcoin has created a whole new generation of crypto-activist who see the power of digital currencies and cryptography in a way that will allow for a new fundamental form of power to exercise itself. The trojan horse is not bitcoin itself, but to see the possibility of real economic independence outside and beyond the control of the state which bitcoin enables. There is no longer any separation between politics and economics, and that is the very space in which we will make the new digital economy, and ensure our liberties through strong crypto.

Through refusing to use their corrupt money that they use for war, oppression, violence, and to keep the general population impoverished; we can force governments everywhere to respect our freedoms which our ancestors fought and died for. The state was never suppose to have economic sovereignty over us, and it is now time for us to reclaim that sacred right, and ensure it can never be taken away again. Strike against state capitalism, and reclaim your financial freedom which was never suppose to be taken in the first place!

Usually a public offering from a company is going to take millions of dollars, lots of legal fees, and huge amounts of regulatory oversight. The massive inefficiencies and regulatory burdens of this process has locked out most people from being able to be involved in this process, and unable to reap the massive profits that can come from high-risk investing like this. Now with the ability to raise tens of millions of dollars using cryptocurrencies, almost anyone can create a public offering for just fractions of what it once cost. The most common way of doing this with crypto at this time is through an initial coin offering (ICO).

Usually a public offering from a company is going to take millions of dollars, lots of legal fees, and huge amounts of regulatory oversight. The massive inefficiencies and regulatory burdens of this process has locked out most people from being able to be involved in this process, and unable to reap the massive profits that can come from high-risk investing like this. Now with the ability to raise tens of millions of dollars using cryptocurrencies, almost anyone can create a public offering for just fractions of what it once cost. The most common way of doing this with crypto at this time is through an initial coin offering (ICO). Monero in many ways is what bitcoin originally wanted to be. Using a new kind of cryptographic protocol that is different from bitcoin, Monero provides strong anonymity that ensures that users financial information, along with their personal identity is much harder to track then it is with bitcoin. For this reason, several darknet markets have recently started supporting Monero, and Monero looks like it is trying to create its own niche within the cryptoeconomy centered around true anonymity and privacy.

Monero in many ways is what bitcoin originally wanted to be. Using a new kind of cryptographic protocol that is different from bitcoin, Monero provides strong anonymity that ensures that users financial information, along with their personal identity is much harder to track then it is with bitcoin. For this reason, several darknet markets have recently started supporting Monero, and Monero looks like it is trying to create its own niche within the cryptoeconomy centered around true anonymity and privacy. Augur is a Dapp, meaning that it was built on top of etheruem as a decentralized app. Augur is the first of a few different prediction market apps that seek to create a prediction platform by letting users bet on pretty much anything. You can check out more information about it here:

Augur is a Dapp, meaning that it was built on top of etheruem as a decentralized app. Augur is the first of a few different prediction market apps that seek to create a prediction platform by letting users bet on pretty much anything. You can check out more information about it here:  There are a few different projects similar to FileCoin such as Storj and Madesafe, which are all seeking to create a decentralized storage and hosting solution for the web. These are the kinds of huge, infrastructure changing, decentralizing projects which I think can radically change the internet, and in turn society itself. While FileCoin has not had an ICO yet, both Madesafe and Storj have, and they also have small limited application of the project released. These are the sort of radical project that are creating the new cryptoeconomy.

There are a few different projects similar to FileCoin such as Storj and Madesafe, which are all seeking to create a decentralized storage and hosting solution for the web. These are the kinds of huge, infrastructure changing, decentralizing projects which I think can radically change the internet, and in turn society itself. While FileCoin has not had an ICO yet, both Madesafe and Storj have, and they also have small limited application of the project released. These are the sort of radical project that are creating the new cryptoeconomy.